Weekly Product Tanker Report (Week 26)

It's just a jump to the left, and then a step to the right. Vessel supply curves do a dance.

The full 9-page Weekly Product Tanker Report is contained in the pdf below:

Market Overview

Following the US bombing of Iranian nuclear sites, and a milquetoast response from the Iranians, the shipping markets breathed a sigh of relief that the long-feared Strait of Hormuz conflagration was unlikely.

Given the uncertainty of transiting the Hormuz, owners had withheld tonnage and did not offer in to AG cargoes, sending rates skyrocketing, as they shifted vessel supply curves to the left. With resumed supply, they are now moving back to the right.

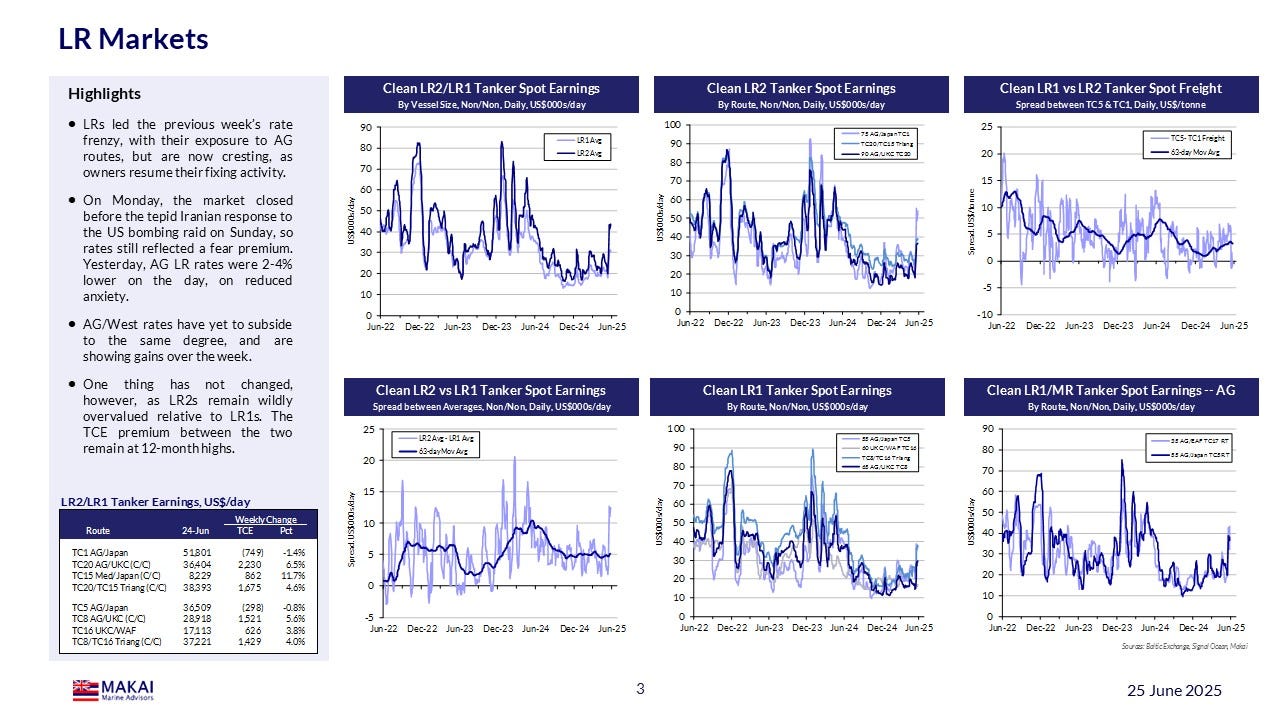

As of yesterday, the freight rate response to this episode was still evident, however, as our index of clean tanker earnings gained 13.8% on the week.

With LR rates peaking, the smaller vessel classes led sector earnings, with strength in Atlantic MRs and another dramatic rebound in Med Handies.

The other pages from our report:

Short-term Outlook

What moves left can also move back to the right -- Fears of a Hormuz closure or attacks on commercial shipping forced owners to withhold tonnage and not offer into AG cargoes. With this leftward shift in the vessel supply curves, AG freight rates more than doubled in days. With the crisis easing, owners are resuming fixtures, moving the vessel supply curves back to the right and lowering rates.

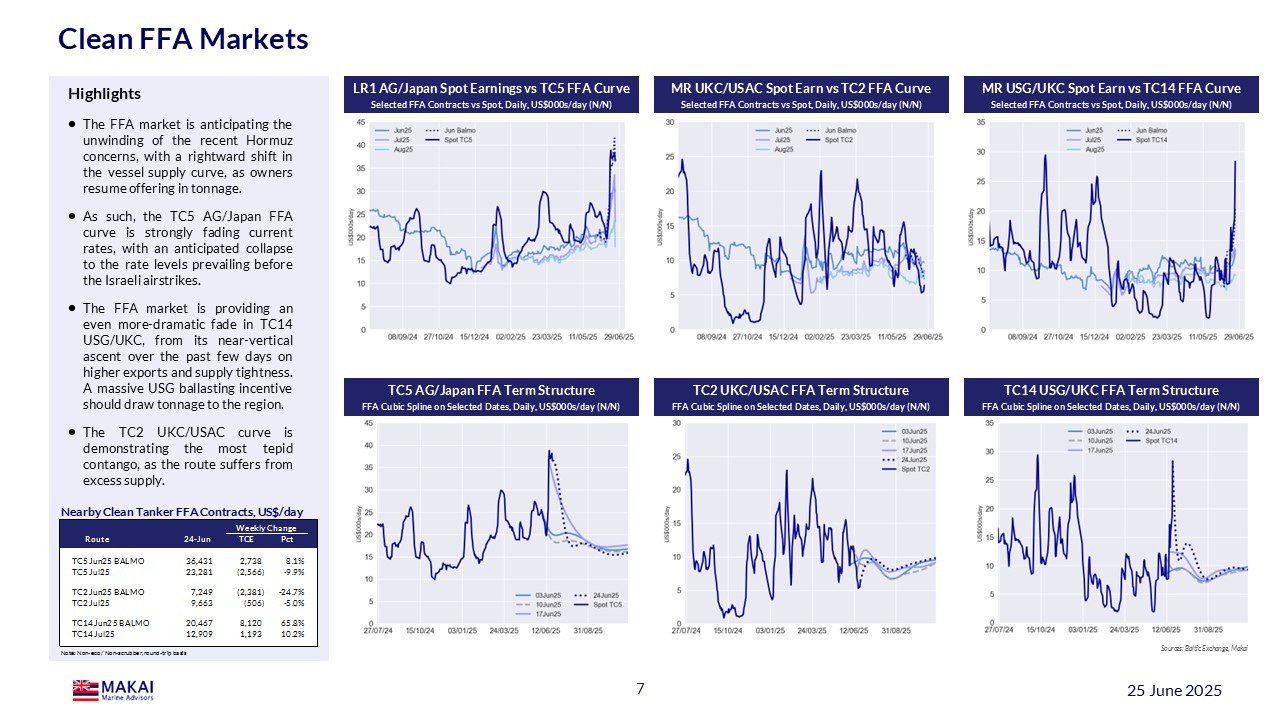

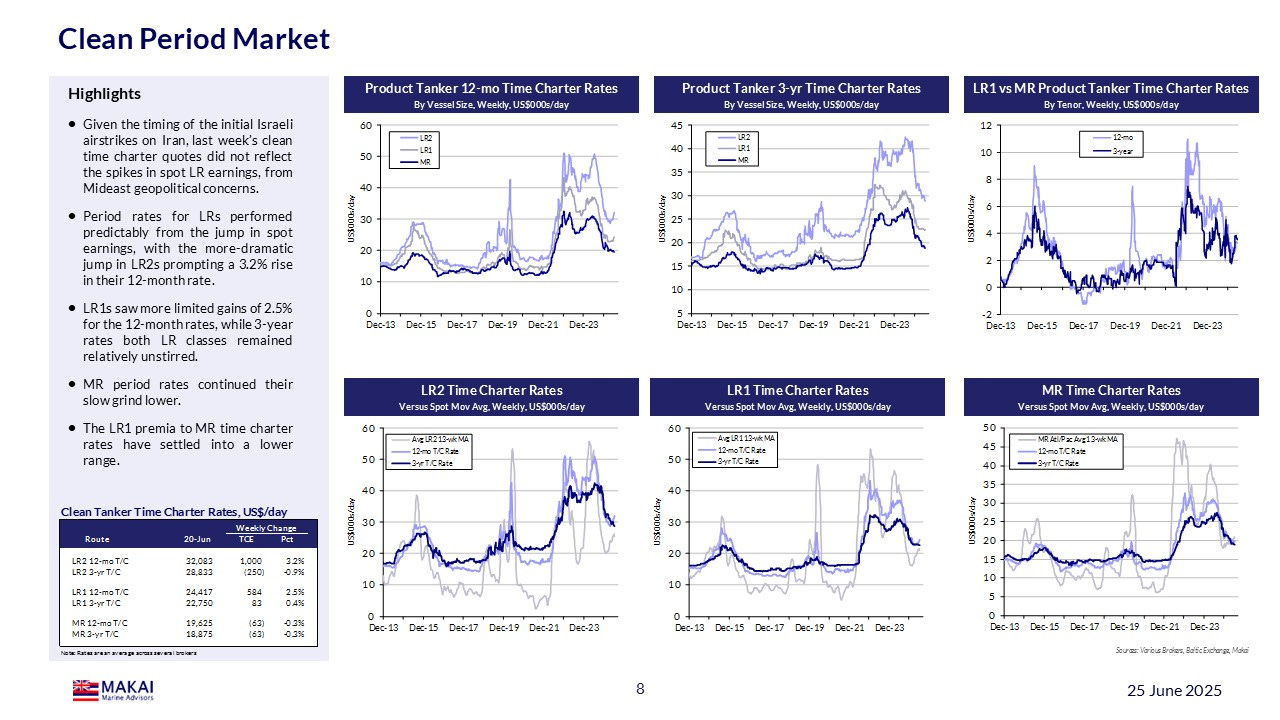

LRs soared on the reduced supply, but now face sharp reversals -- Given their greater exposure to AG cargoes, LR earnings exploded higher on the restriction in supply from owners hesitant to fix. With the Mideast situation calming, resumed vessel supply should push spot earnings lower, as strongly suggested by the FFA market.

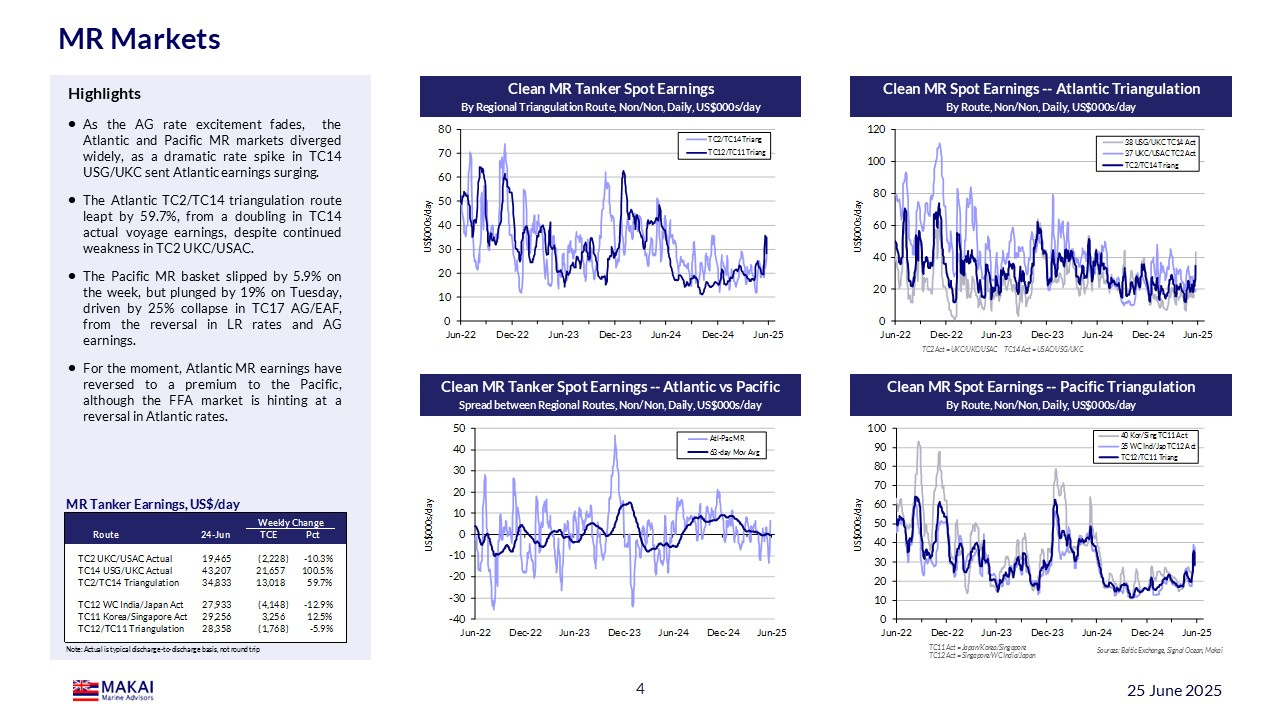

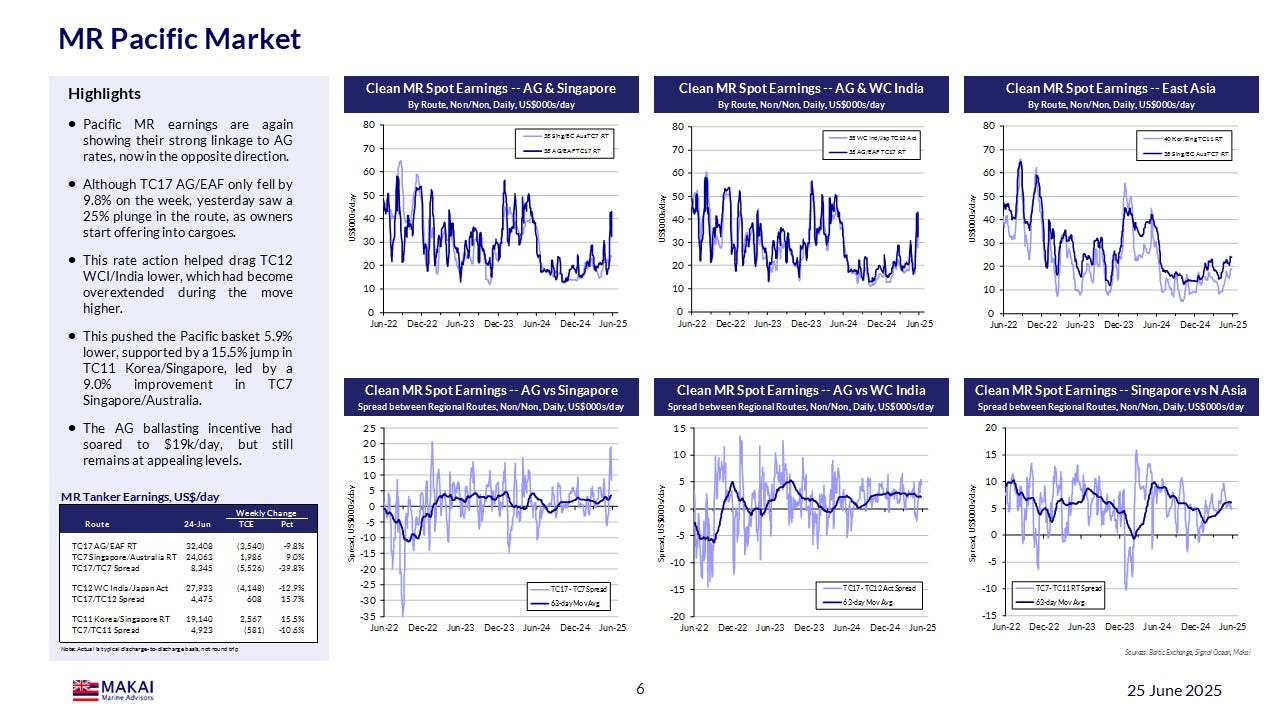

Pacific MRs: Live by the LR sword…. -- Earnings on the Pacific MR basket surged to 12-month highs, as TC17 AG/EAF got caught up in the AG rate frenzy, with a doubling in earnings. A 25% plunge in TC17 earnings on Tuesday is setting in motion further regional declines.

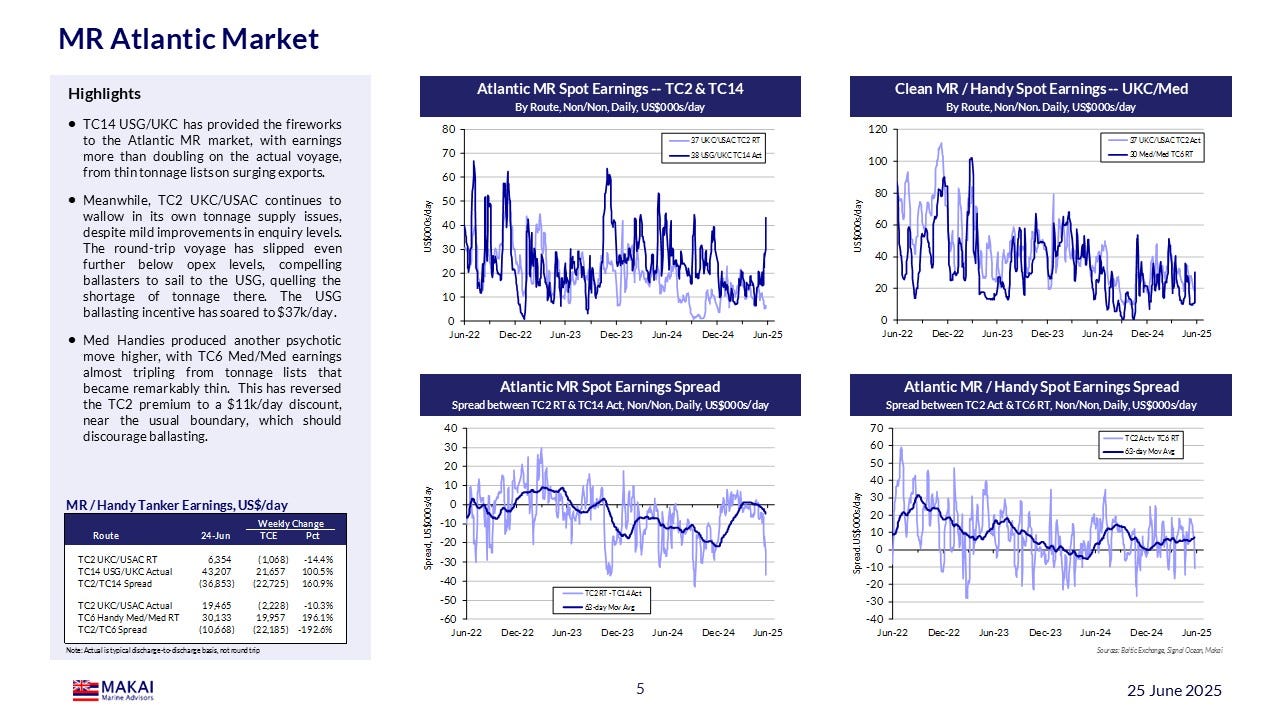

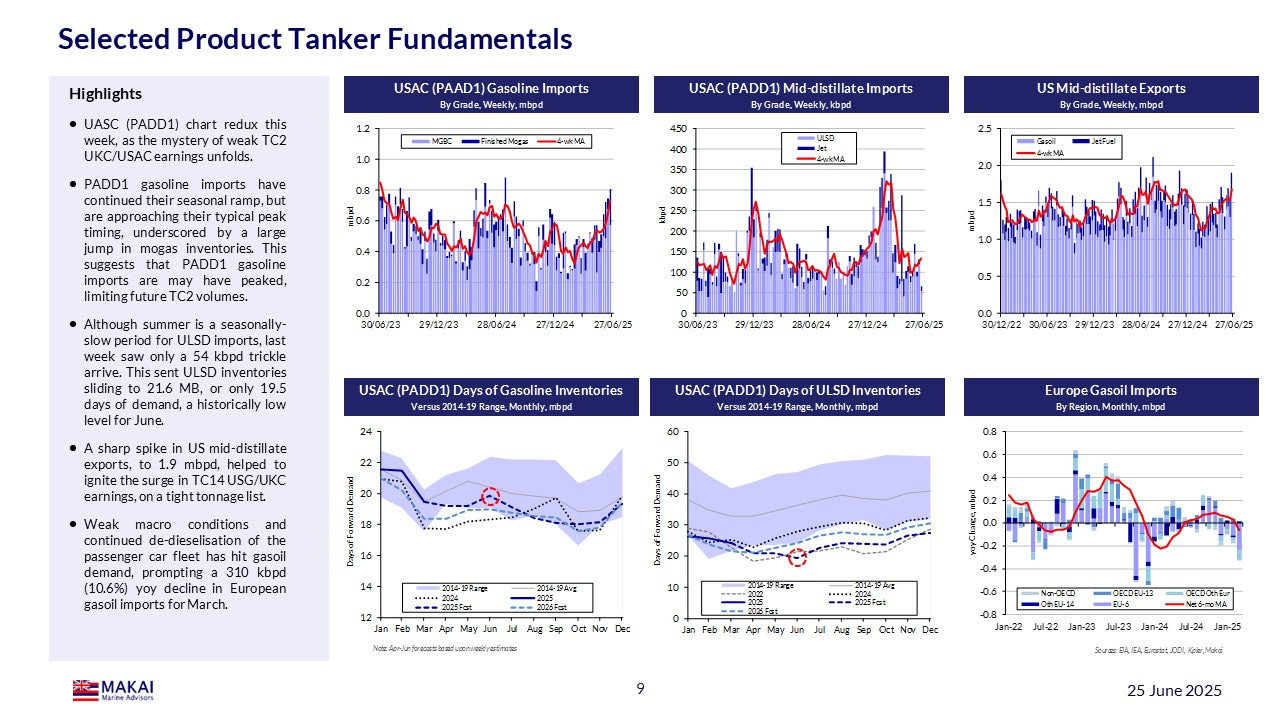

Atlantic MR earnings remain wildly divergent -- A contrast in loadport dynamics, as TC14 USG/UKC soars on a jump in USG product exports and tight tonnage lists, while TC2 UKC/USAC languishes on vessel supply and a potential peak in USAC mogas imports. Expect a re-equilibrium.

Our full Weekly Product Tanker Report is contained in the pdf below: