The full 9-page Weekly Product Tanker Report is contained in the pdf below:

Market Overview

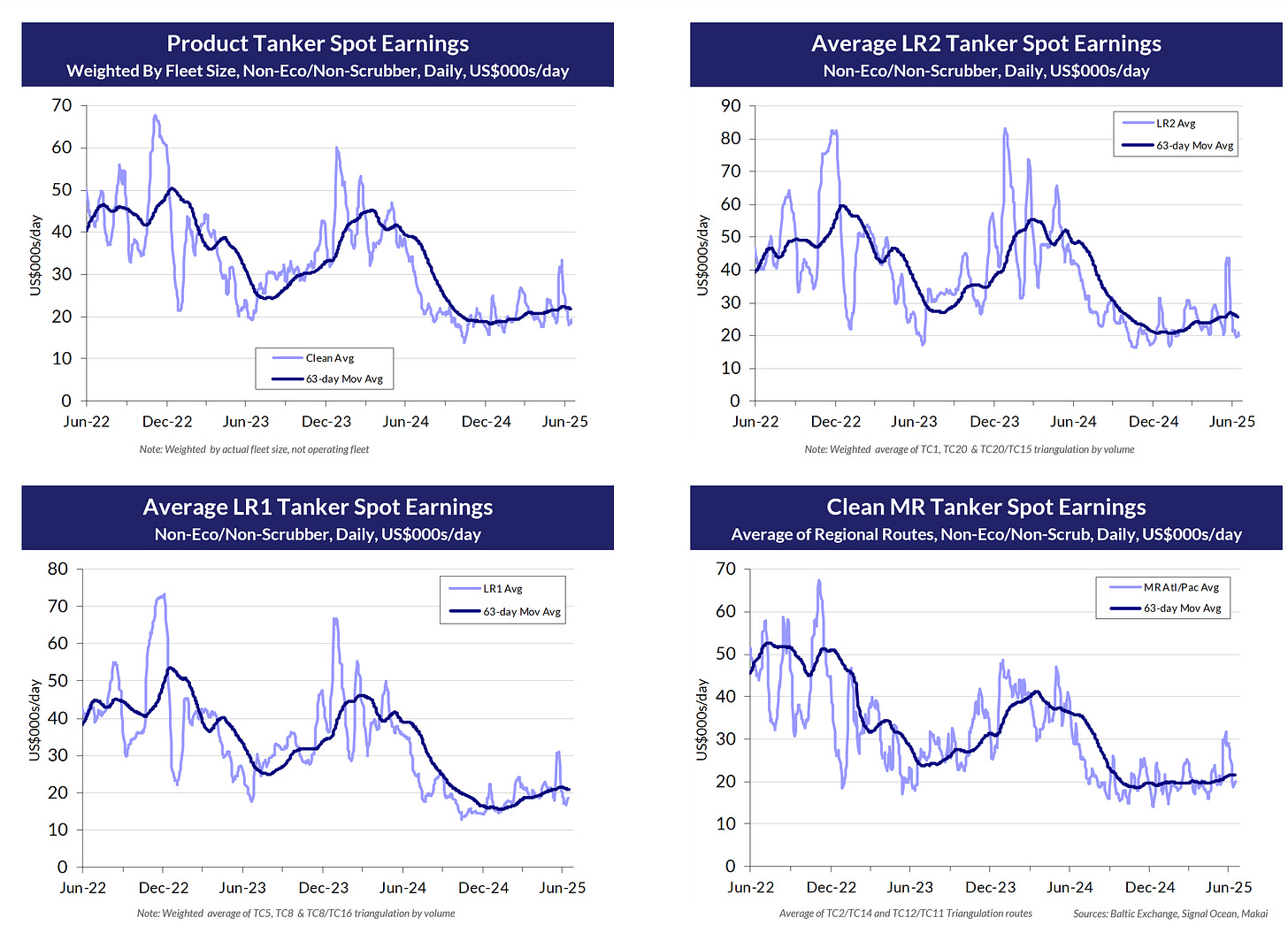

After completing its round trip from the Iranian excitement, the clean tanker market is trying to find a near-term bottom.

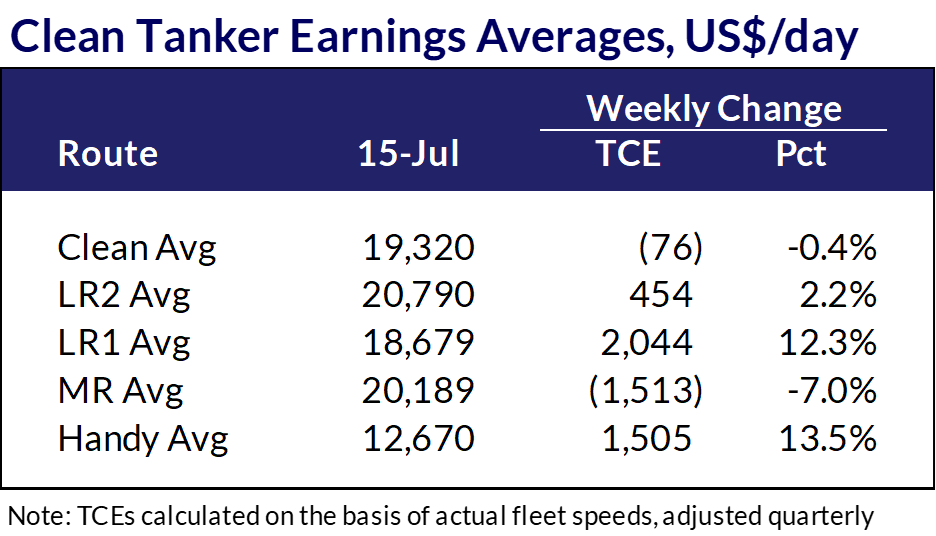

Although our clean tanker earnings average remained roughly unchanged for the week, yesterday’s $19.4k/day level was 6% above Wednesday’s low.

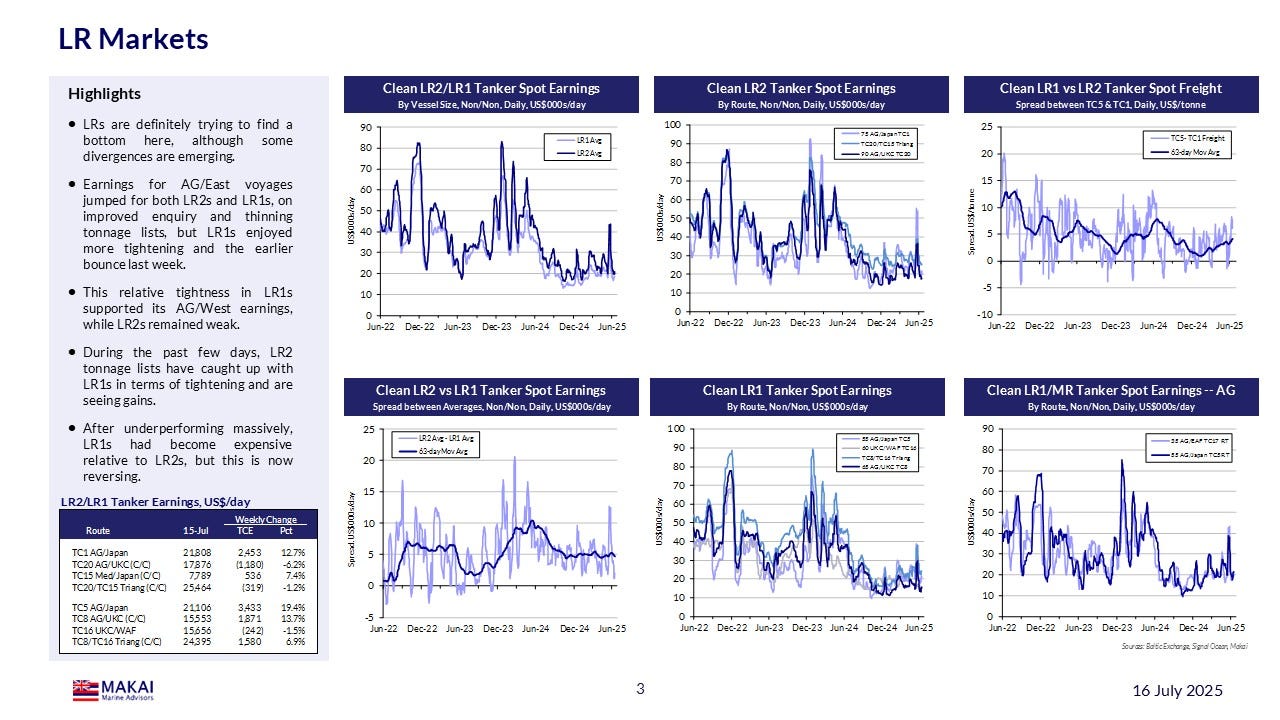

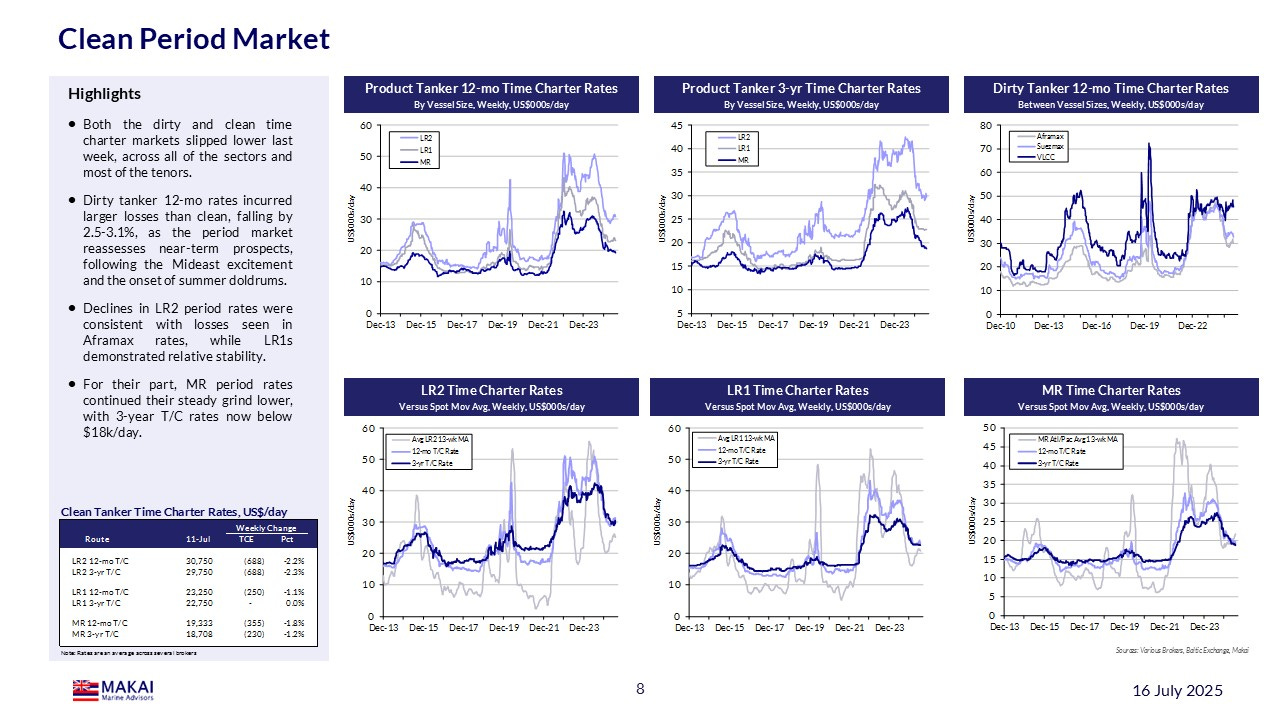

LR2s showed modest gains during the past week, while LR1s outpaced them on tighter AG tonnage lists, helping to slice the LR2 premium further.

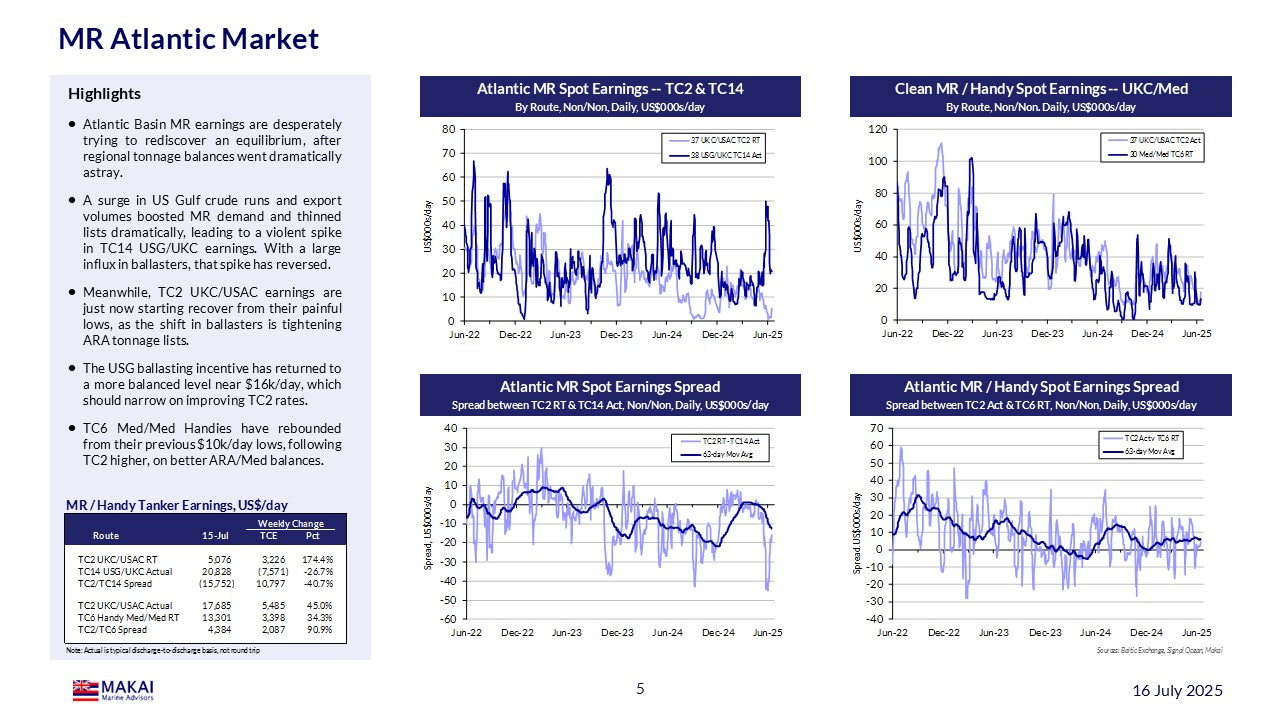

MRs may have experienced a 7% decline during the week, on further Atlantic losses, but yesterday, the sector was 7% above its mid-week lows.

Handies jumped 13%, from a 34% surge in Med earnings, while Pacific Handies languished with regional MRs.

The other pages from our report:

Short-term Outlook

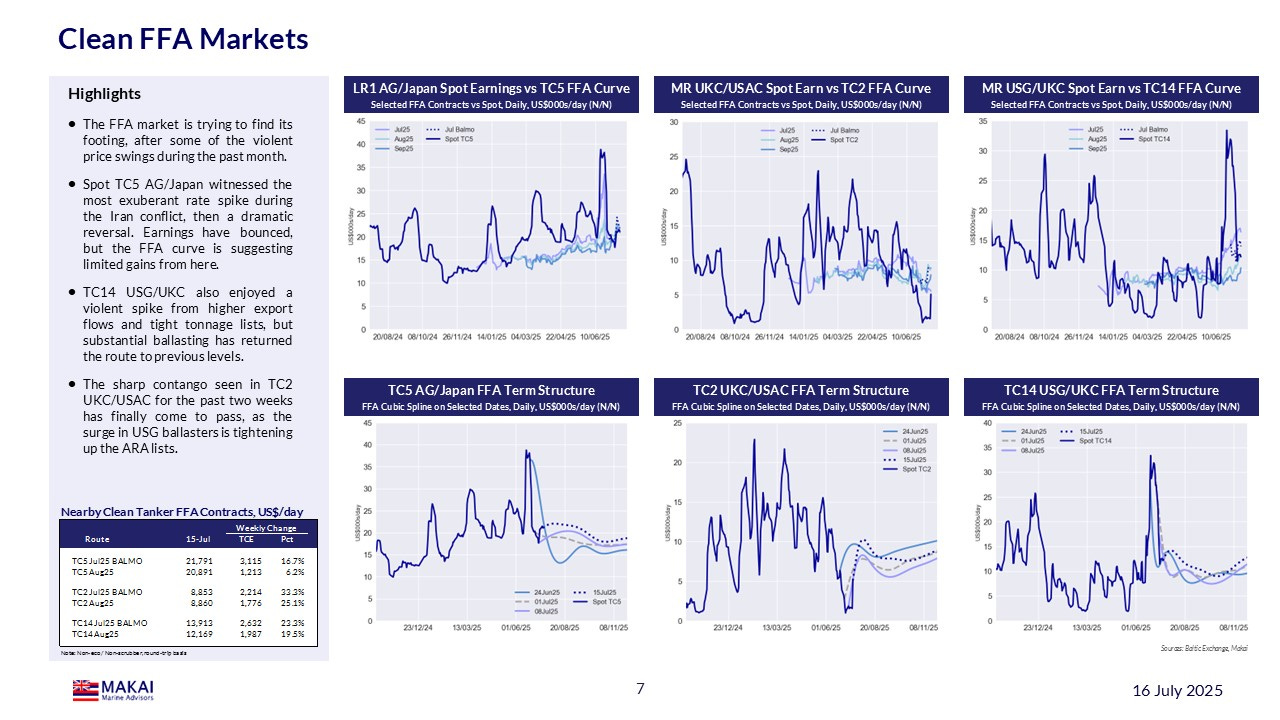

After a full round-trip from the Iranian drama, the clean tanker market is seeking a bottom -- Now back in the familiar $20k/day area for average clean earnings, the market is nudging higher and trying to form a bottom. As the noise from US trade policy is losing its impact and GDP forecasts are improving, the environment is more constructive, but the seasonal peak in global crude runs is only weeks away.

LR earnings are showing improvement on tighter AG balances -- The most exposed to the Mideast crisis, with their heavy AG weighting, LRs were the first to reverse violently and the first to stabilise amongst the sectors. A rise in enquiry levels has thinned tonnage lists, but AG/West routes have not yet fully responded to widening European diesel cracks.

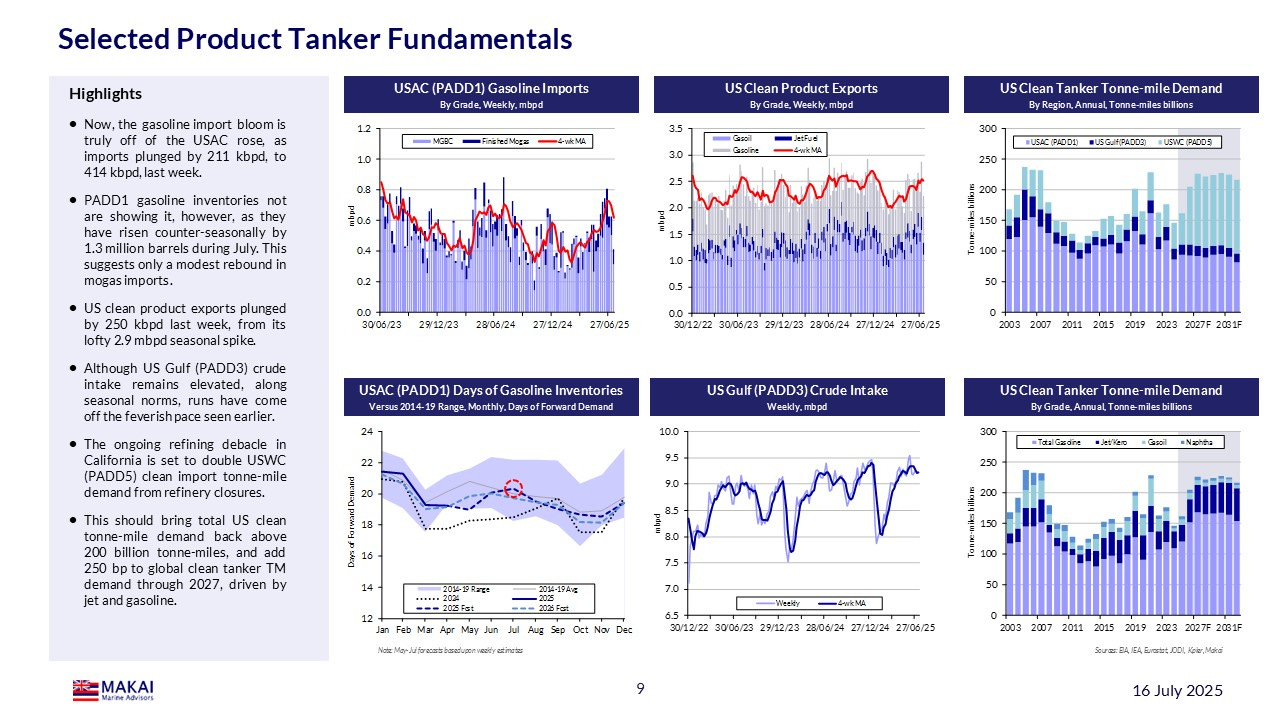

Atlantic MRs are trying to balance their own regional markets via ballasting -- MR markets on either side of the Atlantic became completely out of synch, when surging USG exports thinned lists and sent rates soaring, while NWE earnings collapsed below opex levels. As ballasters have responded to a strong USG incentive, the basin is rediscovering an equilibrium.

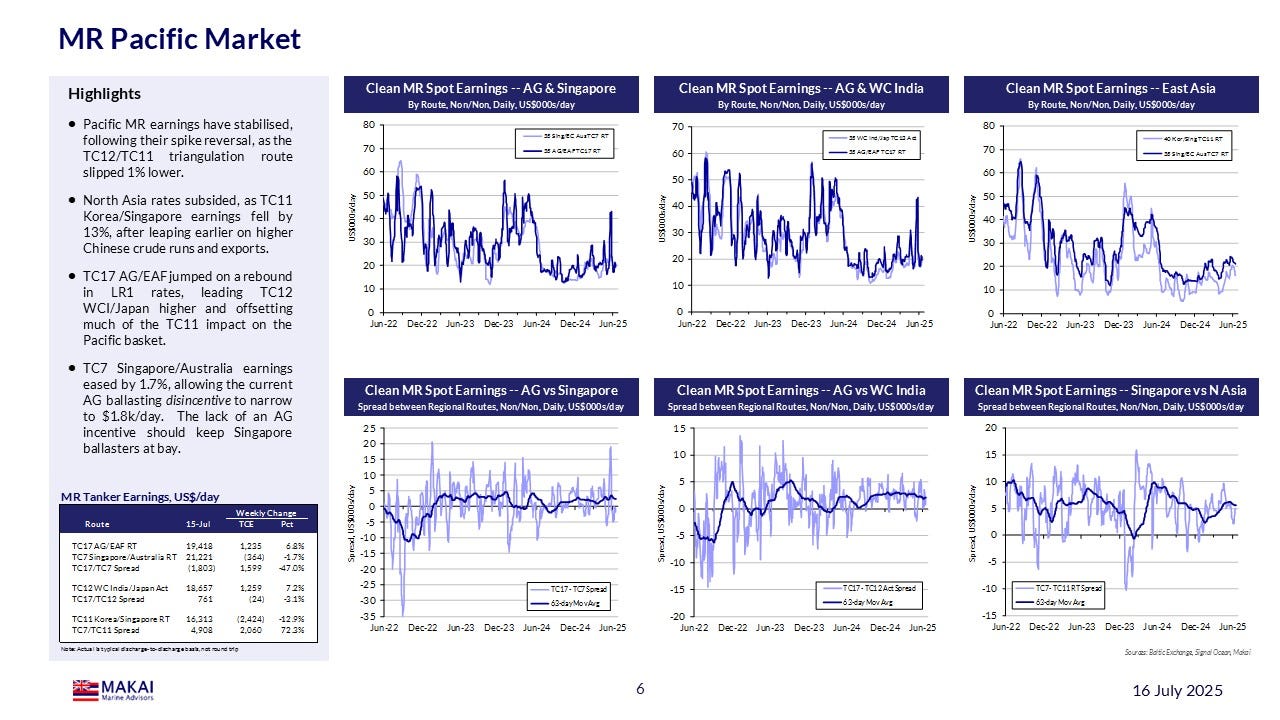

Pacific MR earnings are remaining stable, following their Mideast round trip -- While AG and WCI earnings have followed the uptick in LR rates, North Asia MR earnings have subsided, after enjoying a bounce on Chinese exports during the previous week. Chinese refinery utilisations remain elevated, potentially offering additional support.

Our full Weekly Product Tanker Report is contained in the pdf below: