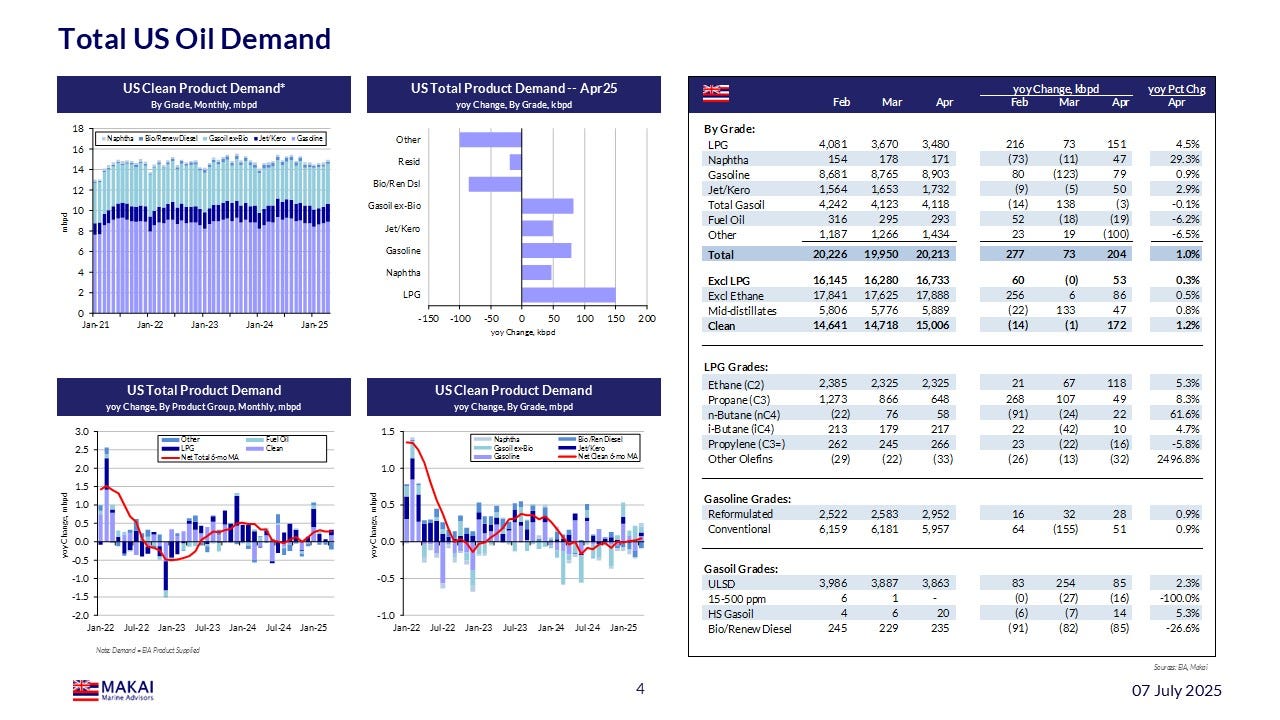

Monthly US Oil Market Report – April Data

As US trade policy descends into a series of tariff deadline extensions, the demand outlook ticks higher

Although US trade policy is still unfolding, the US is extending deadlines and backing away from punitive tariffs, helping to lift some of the demand gloom in place since April. The threat to global trade and oil demand still exists, but the expected value of the different pathways is brightening.

This 62-page pdf report on the US oil markets includes an analysis of the most recent EIA data and provides our quarterly forecasts through 2026.

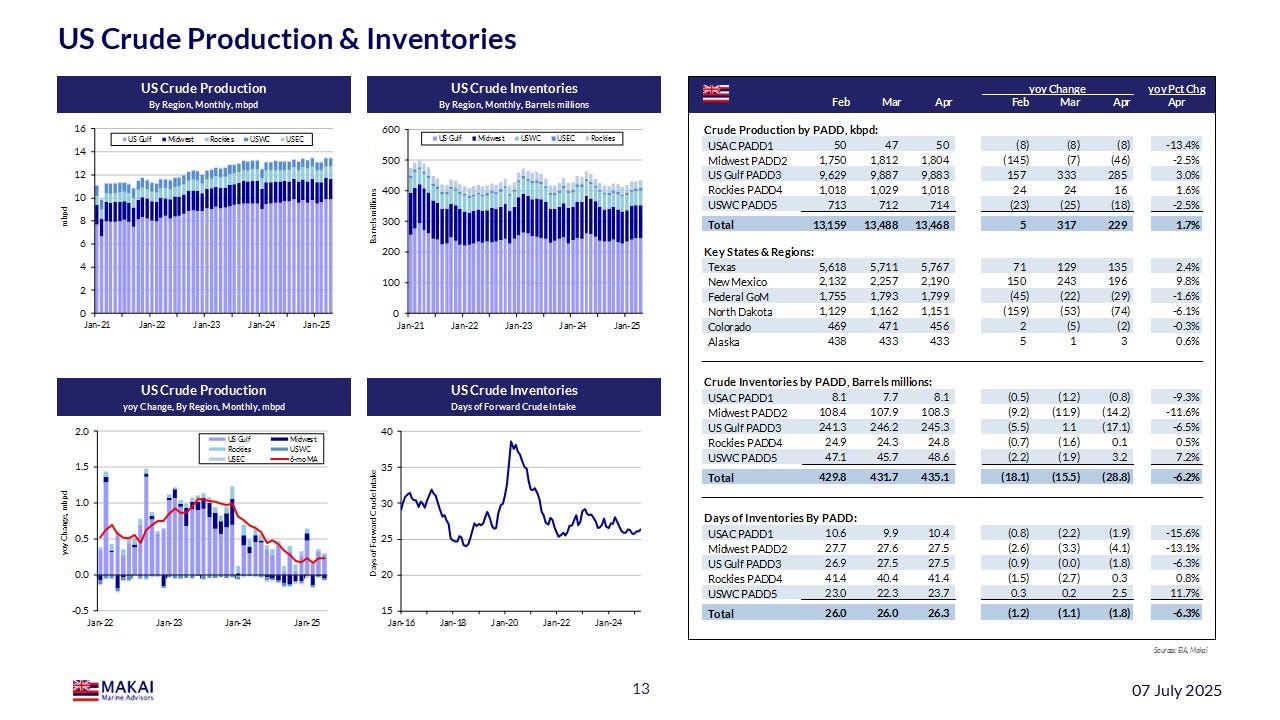

This month, we have added two pages on the US crude oil market, covering production, inventories, trade and inter-PADD movements. We will add analysis on the various shale basins, as well as crude production and trade forecasts in subsequent reports.

The forecast section will remain below the paywall, but the 23 pages above the paywall include a highly-granular analysis of the US oil market. We have provided screenshots of pages from the free section below, as well as a couple of forecast ones. A pdf of these pages may be more convenient and is available below:

Key Observations

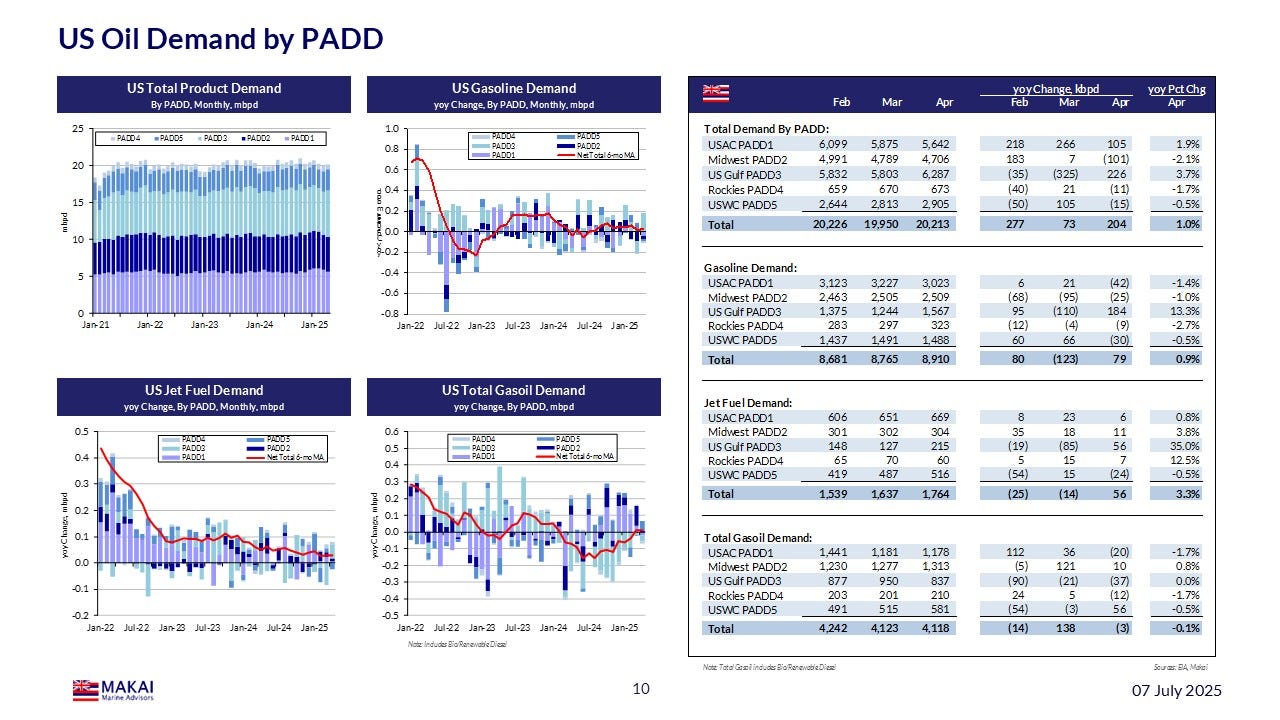

Although US jet fuel demand continues to show gains, the pace is slowing steadily from its strong post-pandemic recovery and last year’s 2.5% jump.

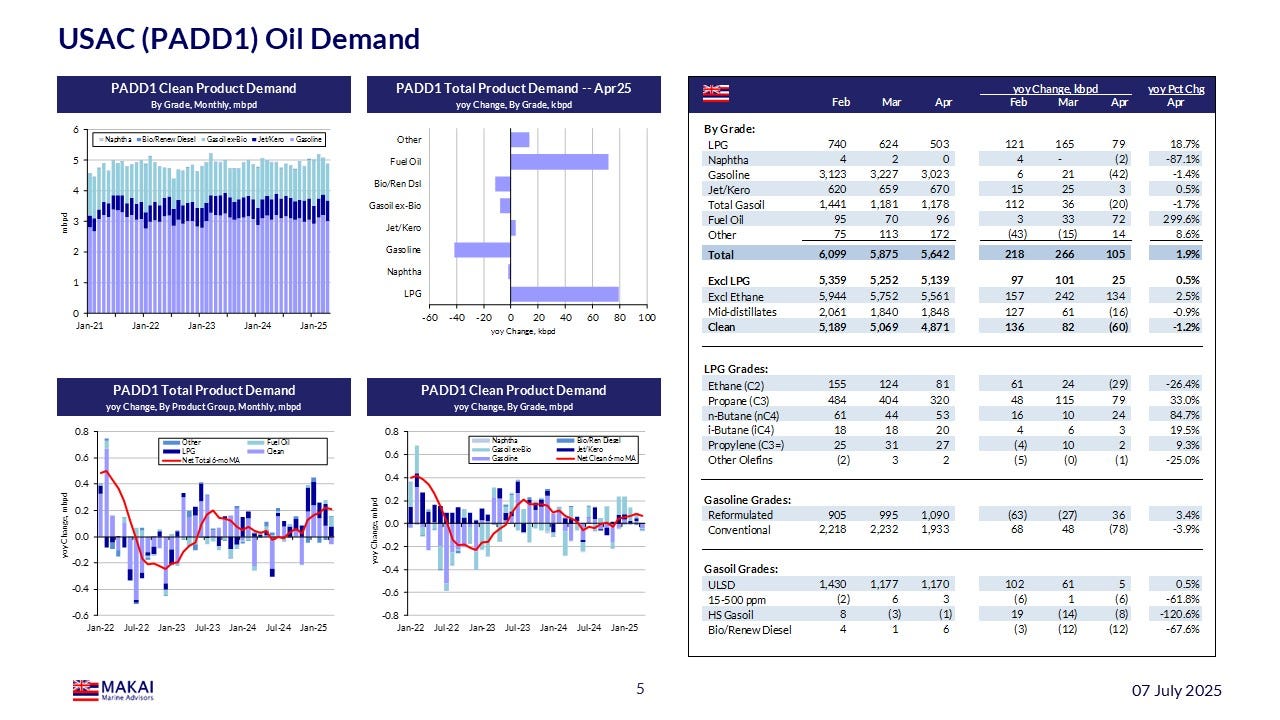

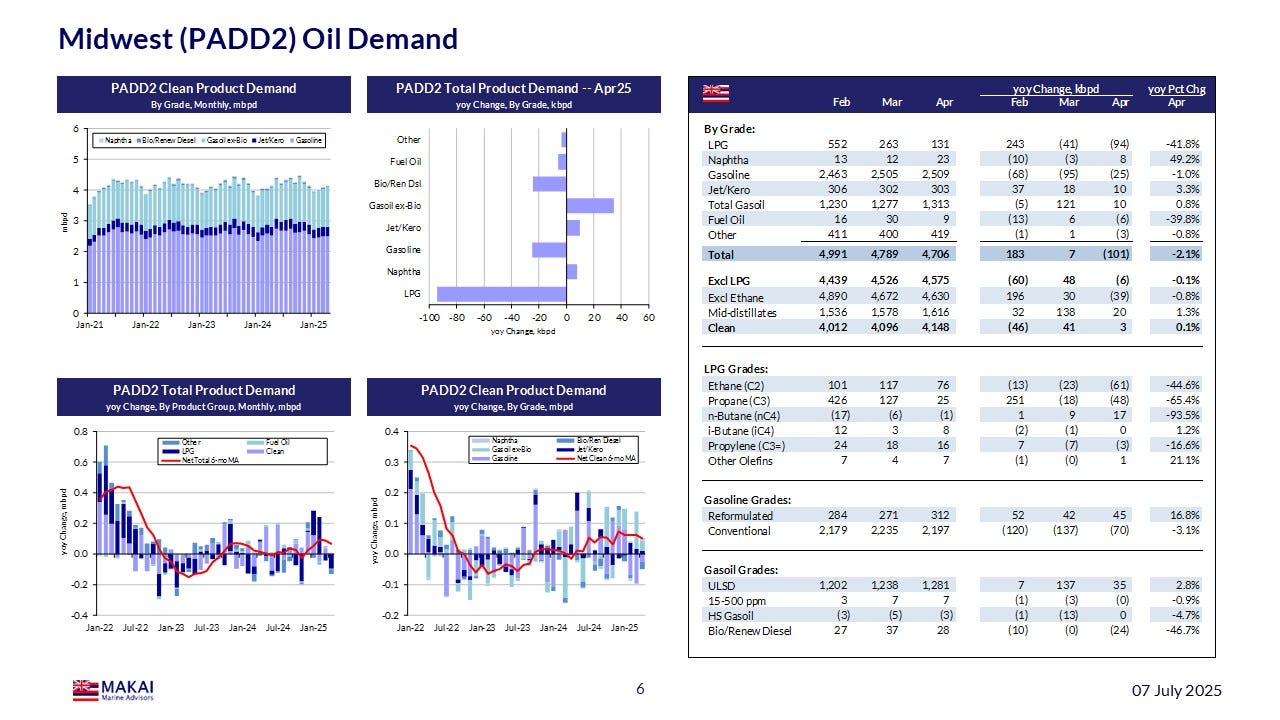

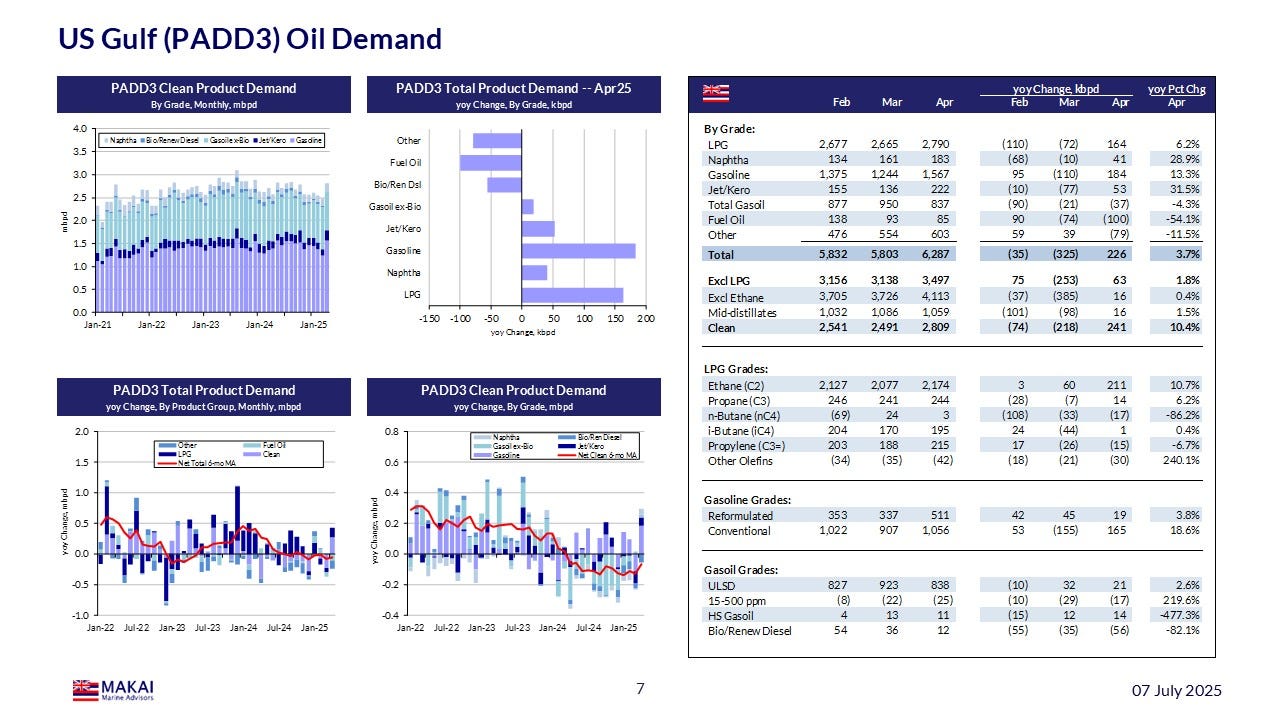

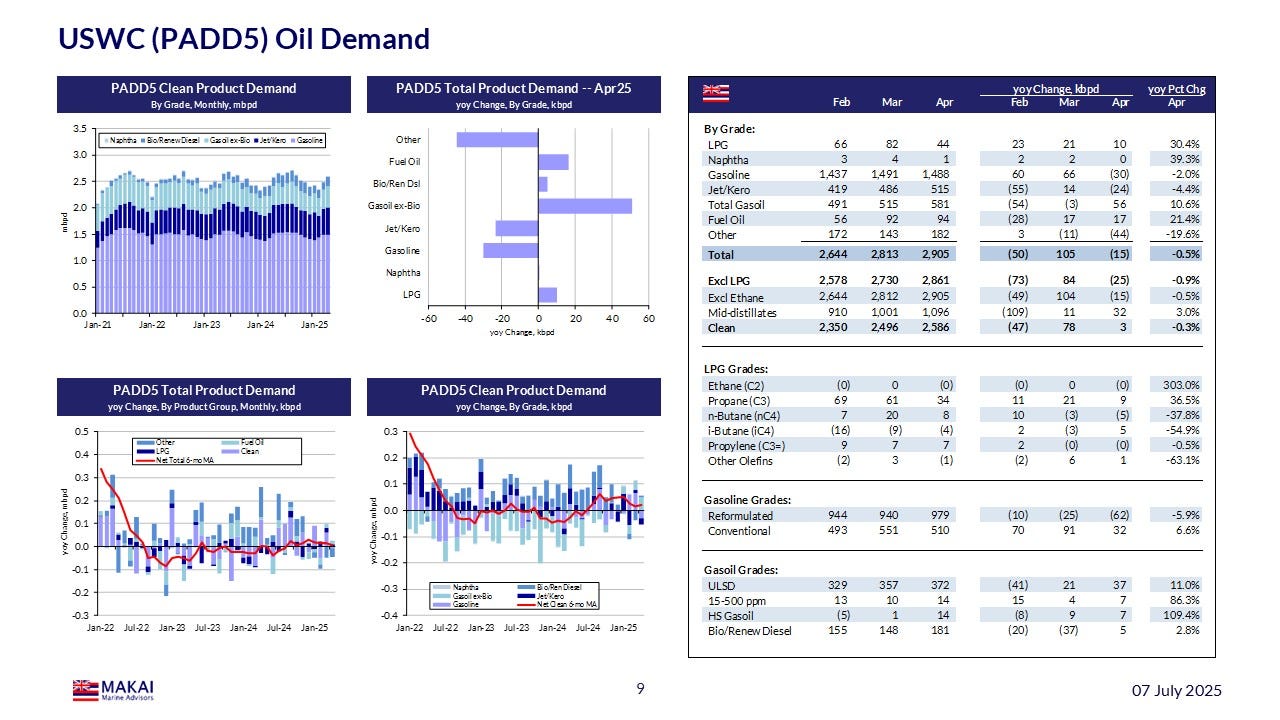

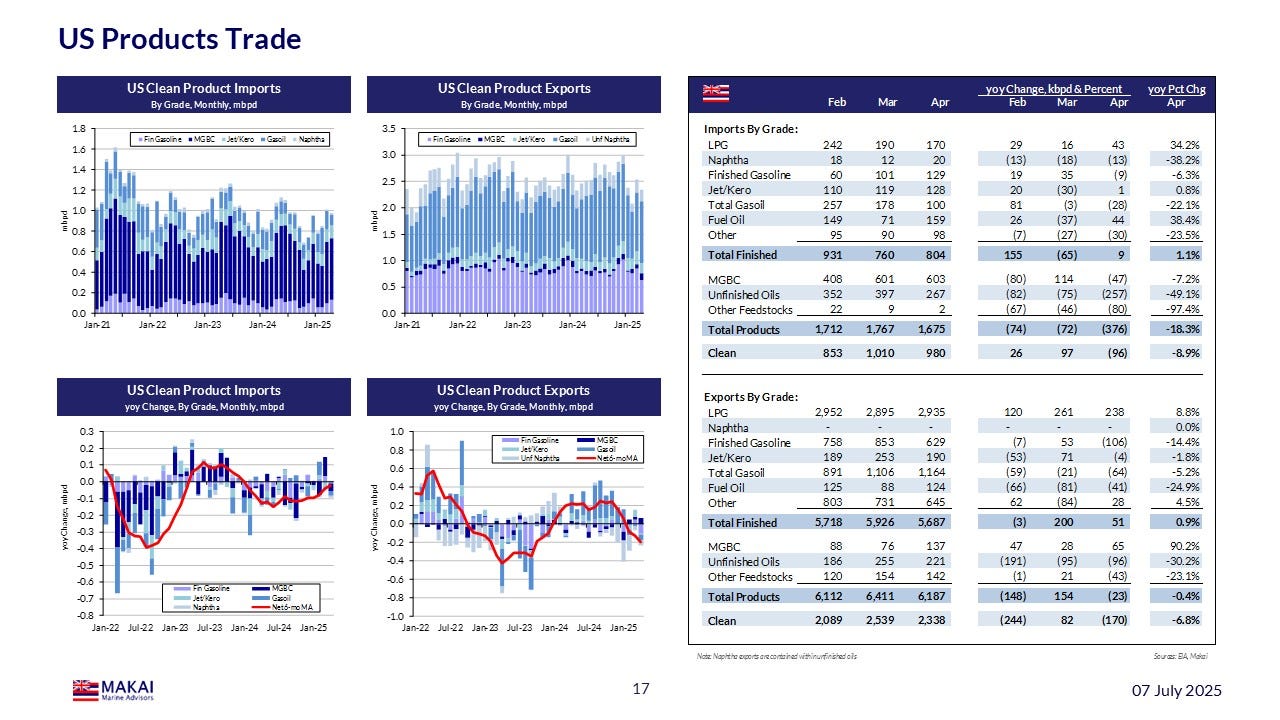

US trade policy remains erratic, but in April, PADD5 total gasoil demand jumped by 56 kbpd yoy, or by 10.6%, as importers jumped ahead of punitive tariffs.

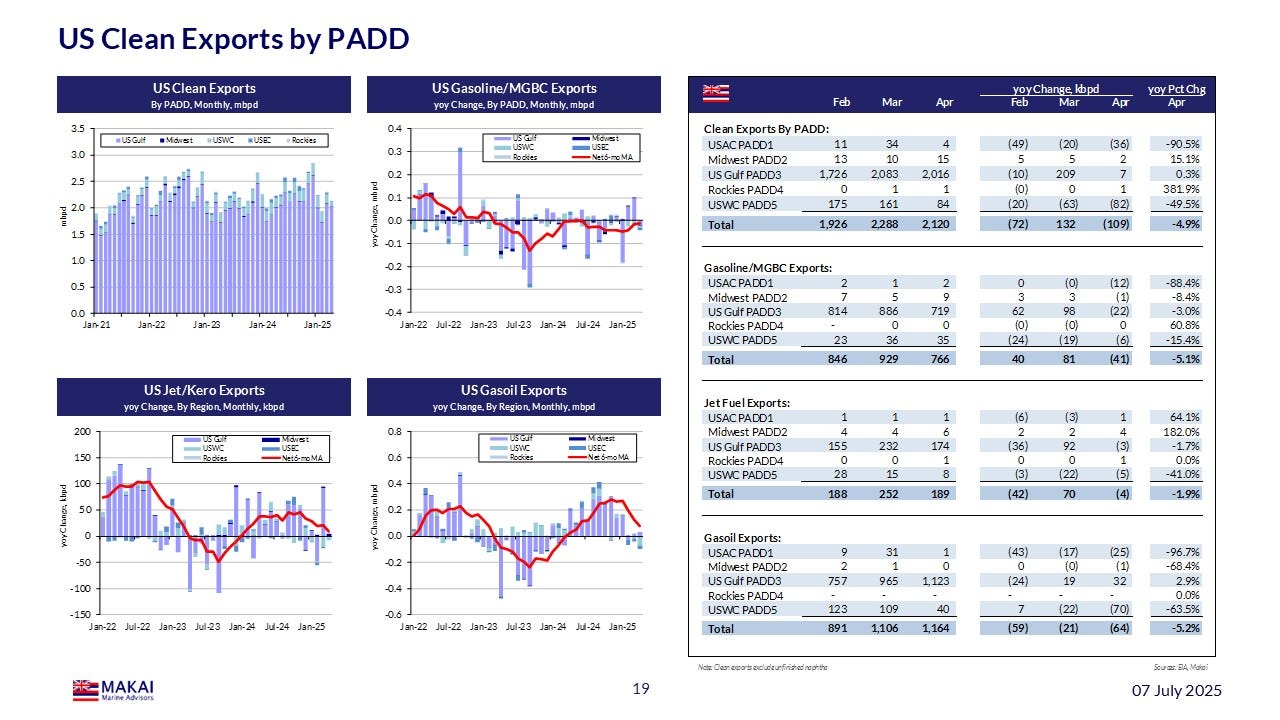

US crude exports continue to slip, with April seeing a 207 kbpd, or 5.3%, yoy drop. This is occurring, despite a 229 kbpd yoy jump in crude production, due to higher crude runs and lower imports.

After heavy maintenance in 1q25, refinery utilisations came roaring back to life in April, hitting 93.0% nationally, 220 bp higher yoy

Although US crude inventories rose by 3.4 million barrels in April, they remain 28.8 MB lower yoy. Days of stocks are 0.3 days lower yoy but remain above 26 days.

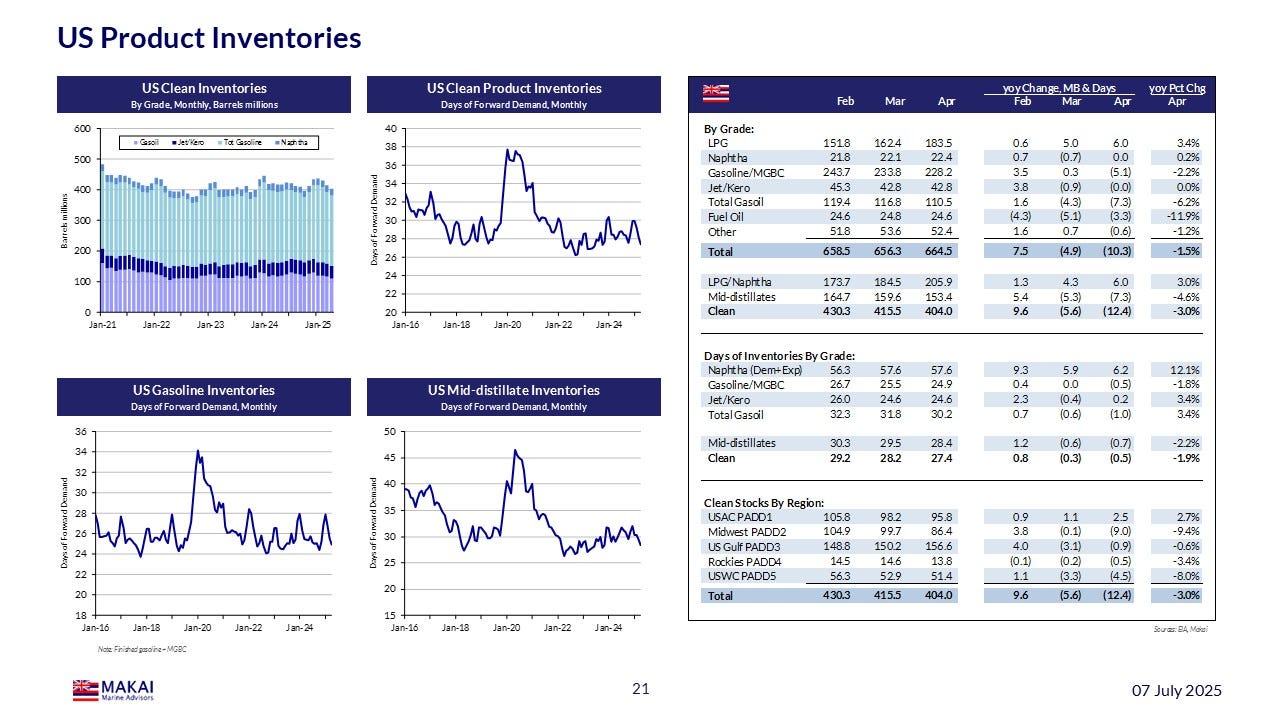

Days of US mid-distillate stocks continue to decline, slipping by 0.8 days in April, to 28.8 days, as inventories fell by 6.3 MB during the month.