Collateral Damage

China’s drive for self-sufficiency in petrochemicals is inflicting pain on its regional neighbours and altering naphtha flows

When Beijing locks onto a major strategic objective, it is rarely a timid affair. So it is with their goal of self-sufficiency in petrochemicals, to slash import dependence. This ambition has launched a staggering surge in chemical construction projects across the Middle Kingdom, leading to a near-doubling of capacity in a few years. With this construction wave, however, China has single-handedly thrown the entire chemical industry into disarray, by creating massive global over-capacity and sending operating rates to unprecedented lows. Europe has been the first victim of this seismic shift, suffering from high-cost plants and a weak macro environment, but the pain is spreading East. Asian petrochemical producers, who have long relied on Chinese markets for their exports, are now struggling, yet more Chinese capacity is arriving for the balance of the decade.

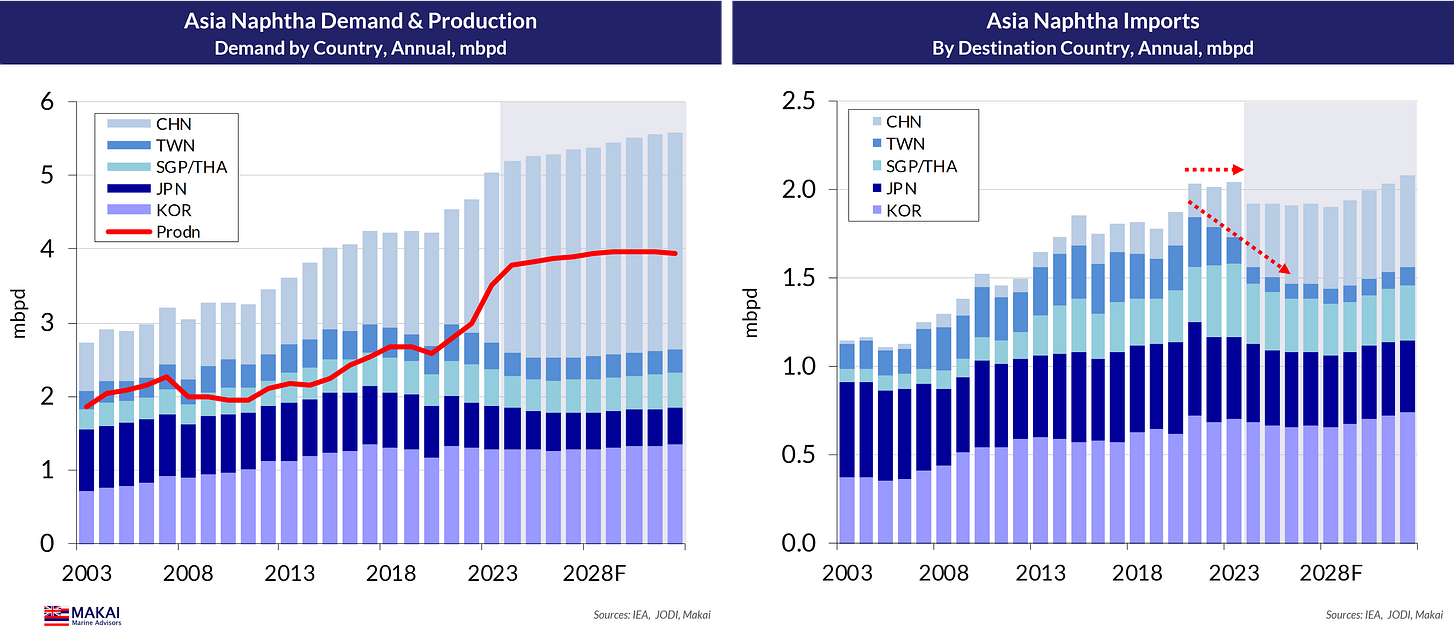

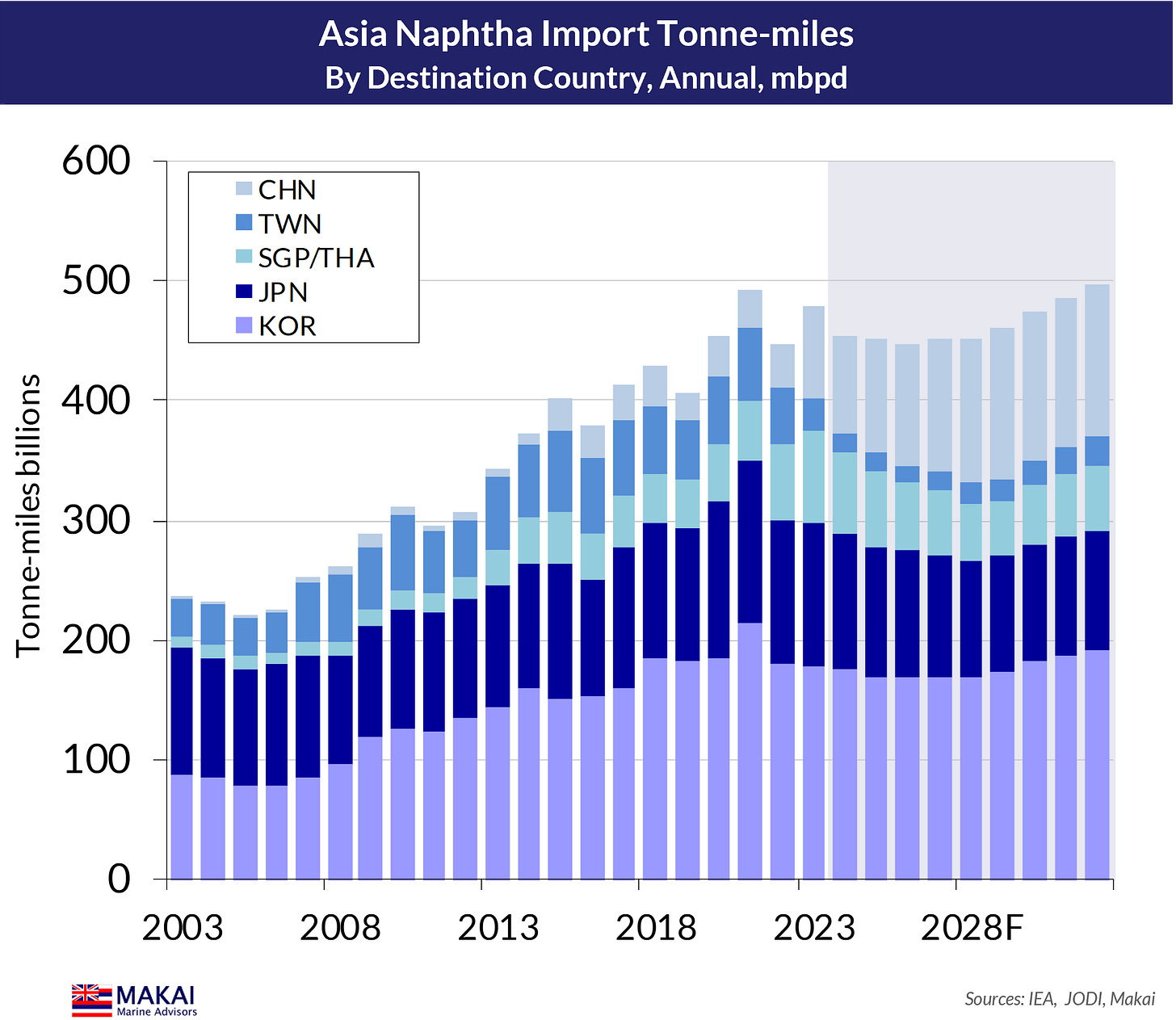

Demand for naphtha, a key petrochemical feedstock, is faltering for these regional producers, and required capacity rationalisation is likely to depress its consumption further, while China sees continued growth. With Asian naphtha imports representing 15% of total clean tanker tonne-mile demand, how these regional import flows evolve will play a key role in how the sector survives a massive orderbook.

China is dominating global ethylene and propylene capacity growth -- During the past five years, Chinese petrochemical producers have boosted their primary processing capacity by close to 80%, while taking a 62% share of global capacity growth.

Overcapacity & weak macro inflicting pain across the entire petchem supply chain -- Weak end user demand and excess steam cracker capacity is pressuring ethylene and propylene pricing and margins, as well as downstream derivative markets.

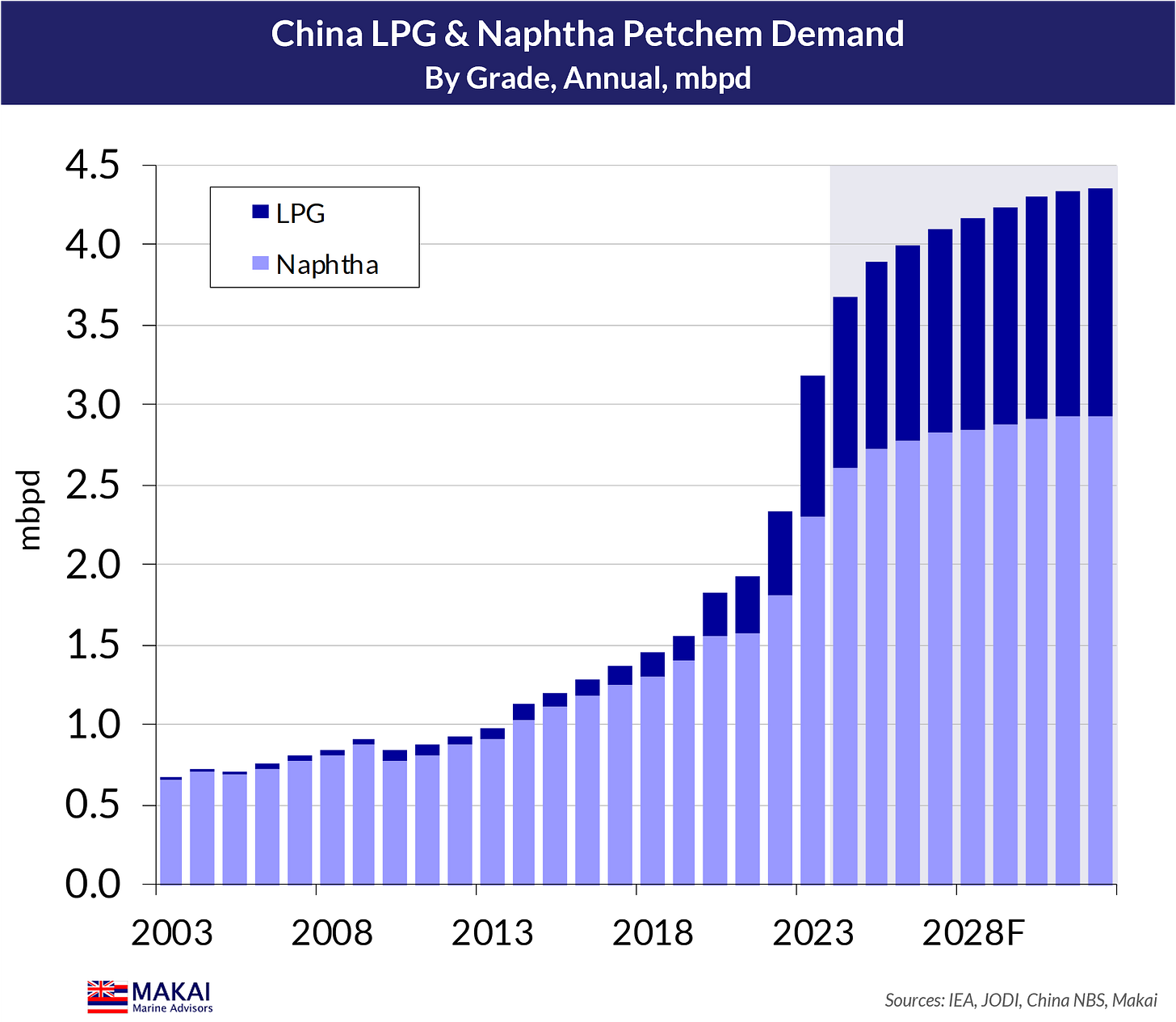

Chinese production growth has shifted to propylene -- Following an earlier wave of capacity additions in ethylene, a surge in propylene capacity is boosting naphtha and propane demand.

Chinese naphtha yields have leapt dramatically -- The majority of recent refinery capacity additions in China have been Crude Oil-to-Chemicals (COTC) refineries, with high naphtha yields to support on site petchem plants.

Extreme market weakness is driving steam cracker rationalisation outside of China -- Europe was the first victim of this excess capacity, suffering from its weak manufacturing base, but now, Asian producers are facing cracker closures.

Asian naphtha import demand stalls after strong growth -- Rising Chinese naphtha production, regional rationalisation and feed switching to propane are all limiting naphtha imports.

Tonne-mile demand growth from Asian naphtha imports is also fading -- A surge in Russian Baltic-sourced naphtha, following sanctions, has boosted tonne-mile demand, but this is slowing, putting Asian tanker demand growth on a slower trajectory.

Explosive Chinese petrochemical industry growth

During the past five years, Chinese petrochemical producers have boosted their primary processing capacity by close to 80%, while taking a 62% share of global capacity growth during that period. This primary capacity includes steam crackers, which use ethane, propane, butane and naphtha feeds to produce the basic building blocks of the chemical supply chain – ethylene and propylene – as well as propane dehydrogenation (PDH) plants, that produce primarily propylene.

The following flow chart shows the basic petrochemical building blocks, their derivative products and applications. A pdf of this from Petrochemicals Europe is available here.

As shown below, Chinese producers added 25.7 million tonnes per annum (mtpa) of ethylene capacity and another 25.1 mtpa of propylene capacity during 2019-23, representing 54% and 75% shares of global capacity additions, respectively. Meanwhile, another 27.9 mtpa and 36.0 mtpa of ethylene and propylene capacity, respectively, are due to arrive in the Middle Kingdom through 2028. Growth during the past five years represents a doubling in Chinese ethylene capacity and a 65% jump in propylene capacity, to 51.3 mtpa and 63.9 mtpa in 2023. The “Others” category in the ethylene chart below is predominantly Middle East projects, with a smattering of US capacity additions, which all rely on cost-advantaged ethane feedstock.

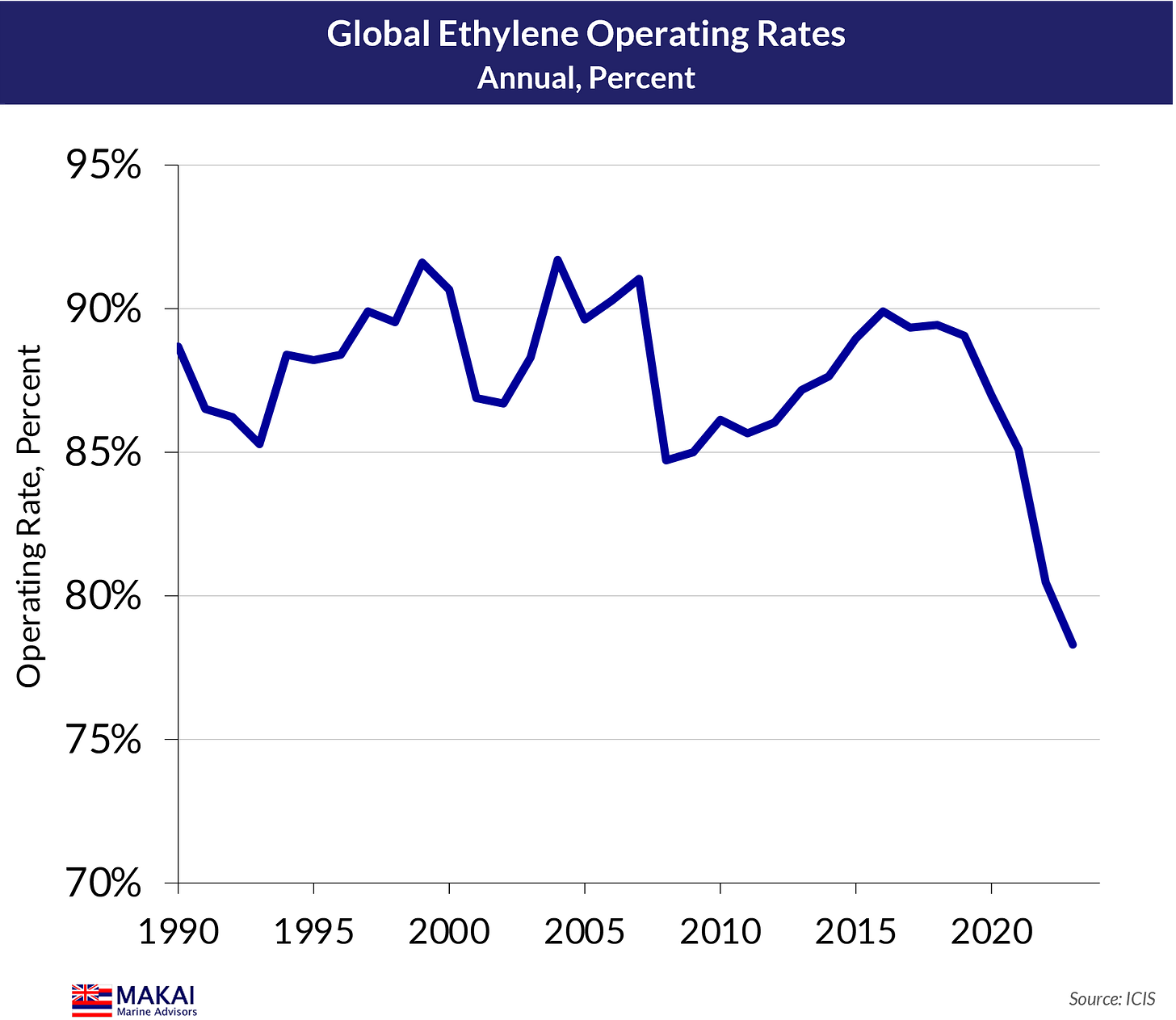

Unfortunately, China, by driving this astonishing growth in global capacity, has precipitated an unprecedented collapse in ethylene and propylene operating rates, as petchem demand has failed to keep up with the 7.1% average annual growth in global capacity during the past five years.

High-cost European producers have been the first to suffer from this capacity glut, with regional chemical industry operating rates hitting an unstainable 57% in March 2024, according to ICIS. This has already sparked 6.5 mtpa of shuttered chemical plant capacity in Europe during 2023-24, mostly in derivative products, but more seem likely. Of course, chemical industry self-sufficiency is a strategic objective for China, and Beijing is unfazed by the global fallout from this push.

So, the capacity additions continue unabated, and with China polypropylene (PP) consumption now representing 41% of global demand, much of the Chinese emphasis has been on propylene capacity. New PDH units have comprised half of these additions, boosting propane feed requirements. Since heavier feed into steam crackers will produce more propylene and less ethylene, China’s steam cracker feed has been oriented towards naphtha, often in its new COTC refineries.

The effect on Chinese feedstock demand has been predictable, more than doubling since 2018 (below). Petchem demand represents about one third of overall LPG demand, with significant residential consumption.

LPG and naphtha accounted for 53% of China’s 1.7 mbpd of oil demand growth in 2023 and the IEA forecasts that the two grades will generate 72% of its 0.7 mbpd of growth in 2024. Limitations to Chinese NGL transfers and refinery LPG production has left Chinese LPG users reliant on imports to meet demand.

Meanwhile, a significant rise in refinery naphtha production has cut into import requirements, predominantly from Chinese refiners dramatically boosting their naphtha yields over the past three years.

Some of this is from a lighter crude slate, featuring WTI, but much of the naphtha output surge is from COTC refineries that have comprised the majority of recent Chinese refining capacity additions (below).

COTC refineries are designed to limit the output of traditional petroleum products, and instead, generate 40-60% yields of chemicals per barrel of crude. This requires maximising naphtha yields at the expense of gasoline, feeding naphtha into on-site steam crackers, as well as redirecting other refinery flows into intermediate product processes.

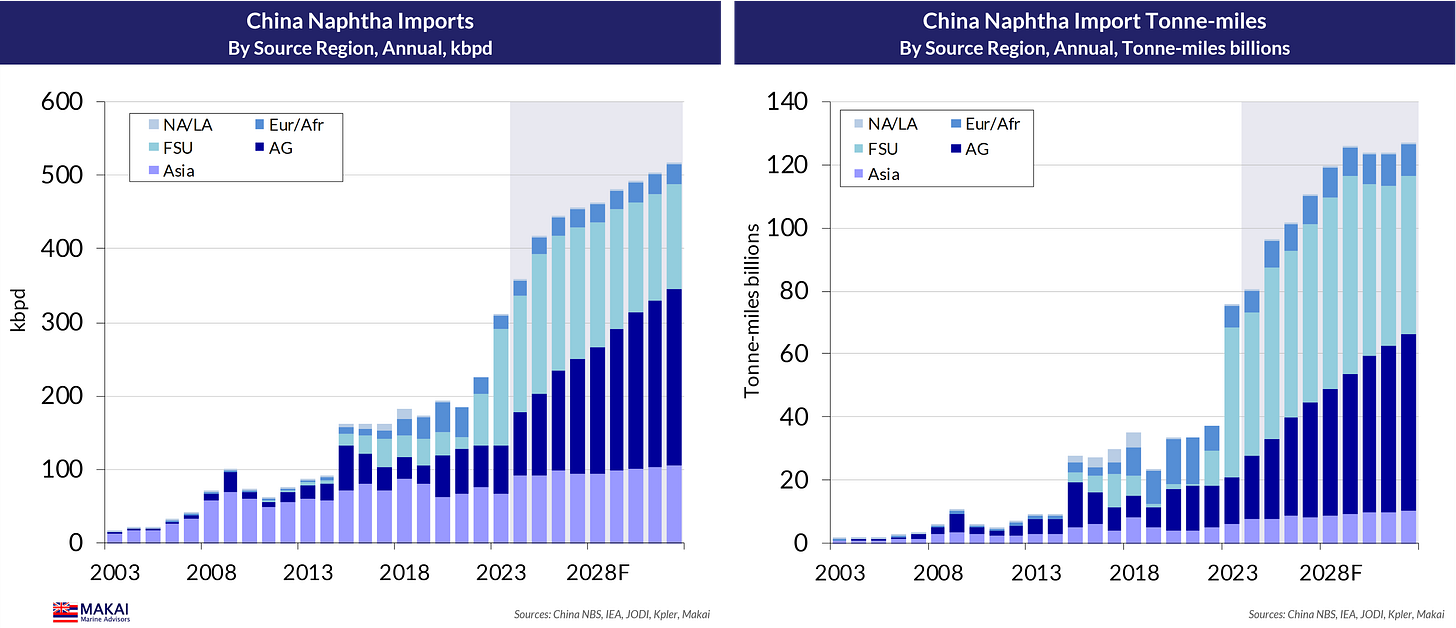

Despite this rise in naphtha production, Chinese naphtha imports have surged since 2021, as China emerged from lockdown and petchem naphtha demand accelerated. Russian naphtha has become a dominant element of this import surge, as Russian exporters pivoted 250 kbpd from Europe to Asia, following the EU import ban.

With much of this material sourced from the Baltic, tonne-mile demand has leapt dramatically. As Russian naphtha exports stabilise, China will need to source incremental barrels from AG refiners.

The walking wounded

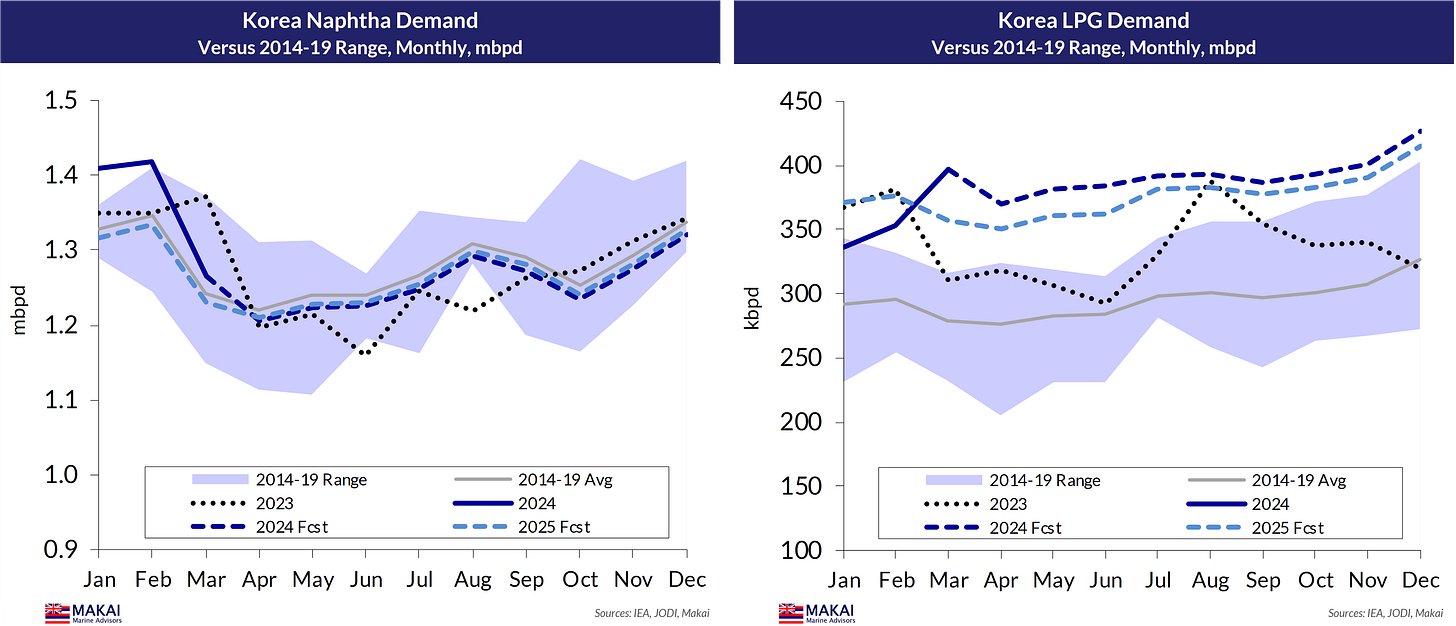

As impressive as this surge in Chinese naphtha imports and tanker demand is, it requires regional and global context. The Chinese push for self-sufficiency has sharply curtailed its chemical import needs, pressuring the operating rates of its suppliers. In fact, China became a net exporter of PP for the first time in March 2024, which is reverberating throughout Asia. Exporters are struggling to find alternative outlets, while domestic producers are facing an onslaught of Chinese products. Consequently, naphtha demand from other Asian producer countries continues to slide (below).

Also, for the moment, propane is a more economical cracker feedstock than naphtha, which is also pressuring 2024 naphtha demand. The charts below show this switch taking place with Korean producers, but these moves are price based and can be ephemeral.

Still, we are probably being generous with these demand forecasts ex-China. ICIS suggests that global ethylene capacity growth needs to be 90% lower than the current line-up of projects in order to bring operating rates back to healthy levels. Given Chinese and Saudi intransigence over their strategic objectives, this probably means similar levels of capacity rationalisation than project cancellations European capacity is most at risk, but Japanese producers have already announced shutdowns.

We will continue to monitor cracker closures, but this demand dynamic is altering Asian naphtha import flows. The chart on the left below superimposes the dramatic jump in naphtha production, mostly from China, versus demand. This is one explanation why Asian naphtha imports remained near 2 mbpd during 2021-23 (lower right), despite surging Chinese demand.

Chinese crowding out of demand from the rest of Asia was another factor, and this trend should continue until cracker operating rates improve outside of China. Taiwan naphtha demand has crashed by 28% since 2021, driving a 45% collapse in imports, suggesting imminent closures, while Singaporean and Thai producers are also at risk.

As shown above, Asian naphtha imports are predominantly from the AG, although pivoted Russian volumes have made a notable appearance in the region. Asian importers have traditionally taken two-thirds of NAF exports of 200 kbpd, but the arb has been closed for most of 2024 (just re-opened). The Asia-sourced volumes are largely from India, but also include re-exported Russian naphtha from Singapore.

Asian naphtha tonne-mile demand reflects this dominance of AG supply into the region, but also the impact of Baltic cargoes (above). Naphtha from NAF, almost exclusively from Algeria, is also a major contributor, and although 2024 TM demand includes COGH routing from the Red Sea situation, a closed arb has limited volumes.

On a destination basis (above), the tonne-mile impact of Chinese chemical producers crowding out regional suppliers is pronounced, with this year’s import patterns providing a 5% decline in total demand and little growth through 2028. China and Singapore TM demand has reflected their reliance on Russian naphtha, as well as Korea’s appetite for it, prior to Russian sanctions. Much of the Singaporean imports from Russia are re-exported to Korea, to circumvent those sanctions, but the Korean authorities are becoming wary.

Although Ukrainian drone attacks on Russian refineries are depressing naphtha and other product exports at the moment, Novatek is starting up a new 3 mtpa condensate splitter in Ust Luga, which should add 50 kbpd to Asian imports. After this impulse, we forecast that Russian naphtha imports will erode gradually on lower refinery throughput, and from steam cracker start-ups there.

Conclusion

In its pursuit of petrochemical self-sufficiency, China has unleashed havoc on the global chemical industry, with levels of overcapacity that offer few avenues for healthy operating rates. For Asian petchem producers who have relied on China as an export destination, the situation is worsening, and the most likely avenue is capacity rationalisation.

Chinese growth in naphtha consumption, imports and tonne-mile demand has been stunning, but the reversal in its regional neighbours’ fortunes leaves the clean tanker market with an unimpressive net result.

Along with lacklustre near-term clean tanker demand from the ASEAN region and Australia/NZ, overall Asian demand is unlikely to offer the clean tanker market any respite from a massive orderbook.

Also, these Asian results are suggesting that up to 90% of this year’s clean tanker demand growth is from the Red Sea crisis. The freight rate theatrics from this situation are obscuring the slowing in post-Covid demand growth elsewhere, which should become more apparent later.

Good as always, thanks.

Great insight! I likes the connection for product tankers to the chemical industry