Canadian barrels too sour for LA refinery palates

Desulphurisation capacity constraints should limit TMX flows to US West Coast

After numerous delays, cost overruns and regulatory wrangles, the Trans Mountain Pipeline Expansion (TMX) is finally poised to commence operation in May. It will provide an additional 590 kbpd of egress for Western Canadian crude, paralleling the existing 300 kbpd Trans Mountain Pipeline (TMP) from Alberta to British Columbia. This is a welcome a relief for Canadian producers, who have long sought an alternative to the US Midwest and US Gulf Coast refiners that dominate current exports.

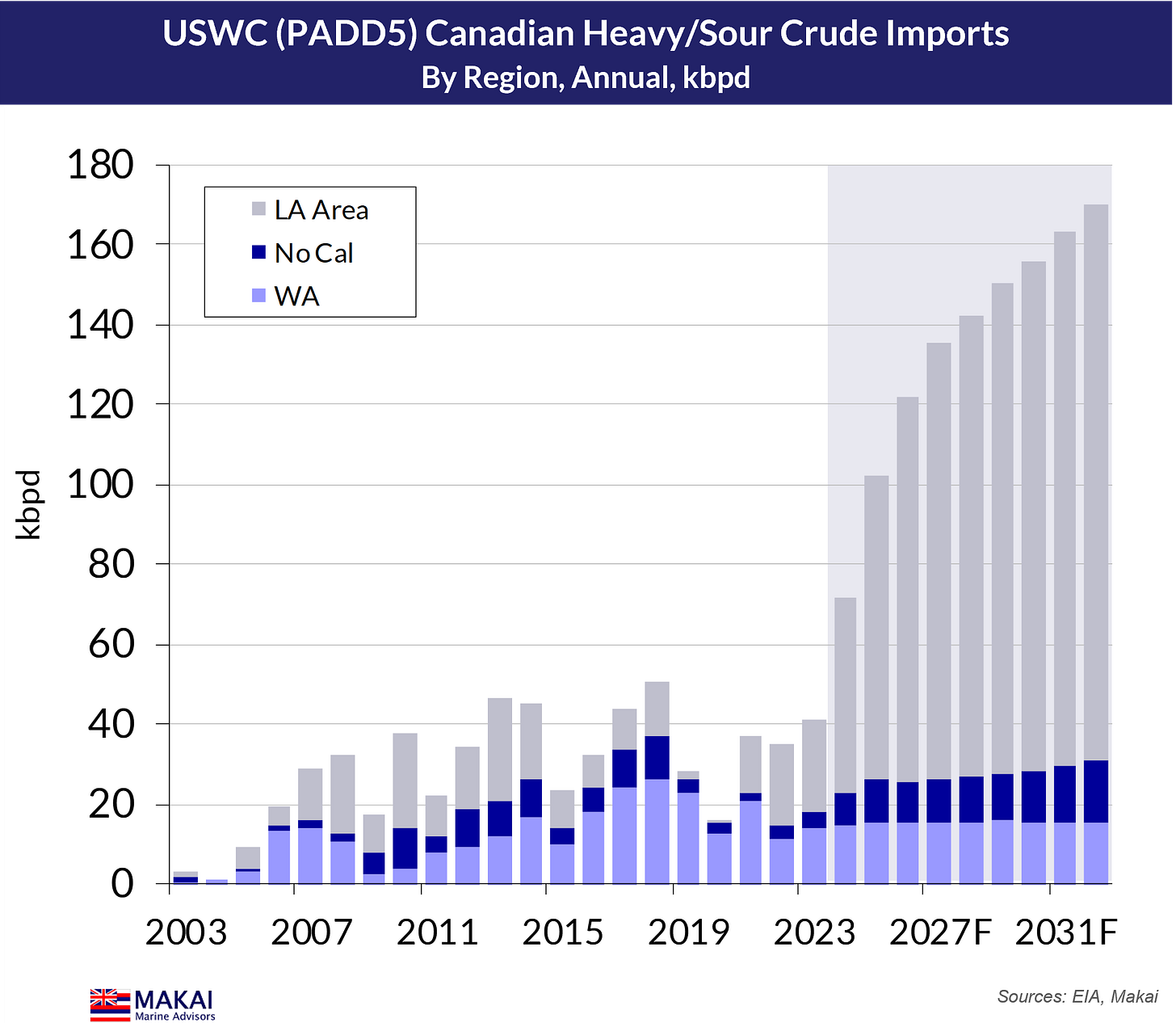

Even before the first barrel flows, the start-up of TMX has prompted a vigorous debate in the tanker markets about where the crude will land. Given the heavy/sour quality of TMX crude, the only viable destinations are those refineries with coking and other resid upgrading capacity, and even these will need to contend with the crude’s high acidity. As a practical matter, this means China and the US West Coast (USWC), although media coverage has tilted towards the USWC as the most frequently-mentioned sure thing. Refinery desulphurisation constraints, however, should limit the amount of TMX crude that USWC refiners can take, sending the balance to Asia.

Declining regional crude production is a key structural issue -- The loss of Alaskan and Californian crude production has boosted USWC (PADD5) crude import demand, but has also created crude quality issues for refiners.

PADD5 refining is heterogenous, with five disparate regions -- Their differing refinery configurations drive varied crude selection criteria and import patterns. For TMX crude, there is no “PADD5” as a destination.

TMX is an LA Story -- In fact, the coking refineries of the Los Angeles (LA) area are the only meaningful destination for TMX heavy/sour crude grades within PADD5, and their constraints will determine the volume of TMX imports.

Additional vac resid from TMX crude is welcome; its sulphur, not so much -- High vacuum residuum (vac resid) yields from TMX grades will help ease a growing shortfall for coker feed, but their 3.75% sulphur content is a problem.

Desulphurisation constraints should limit TMX imports to 130 kbpd -- Lower-sulphur Ecuadorian and Colombian heavy grades remain necessary, but 3% sulphur Basrah Medium may become a high-sulphur extravagance.

New short-haul imports to have a predictable impact on PADD5 tonne-mile demand -- Emergence of TMX crude and displacement of medium/sour Mideast grades would slice PADD5 crude tonne-miles by 15% through 2027.

Dwindling PADD5 Crude Production

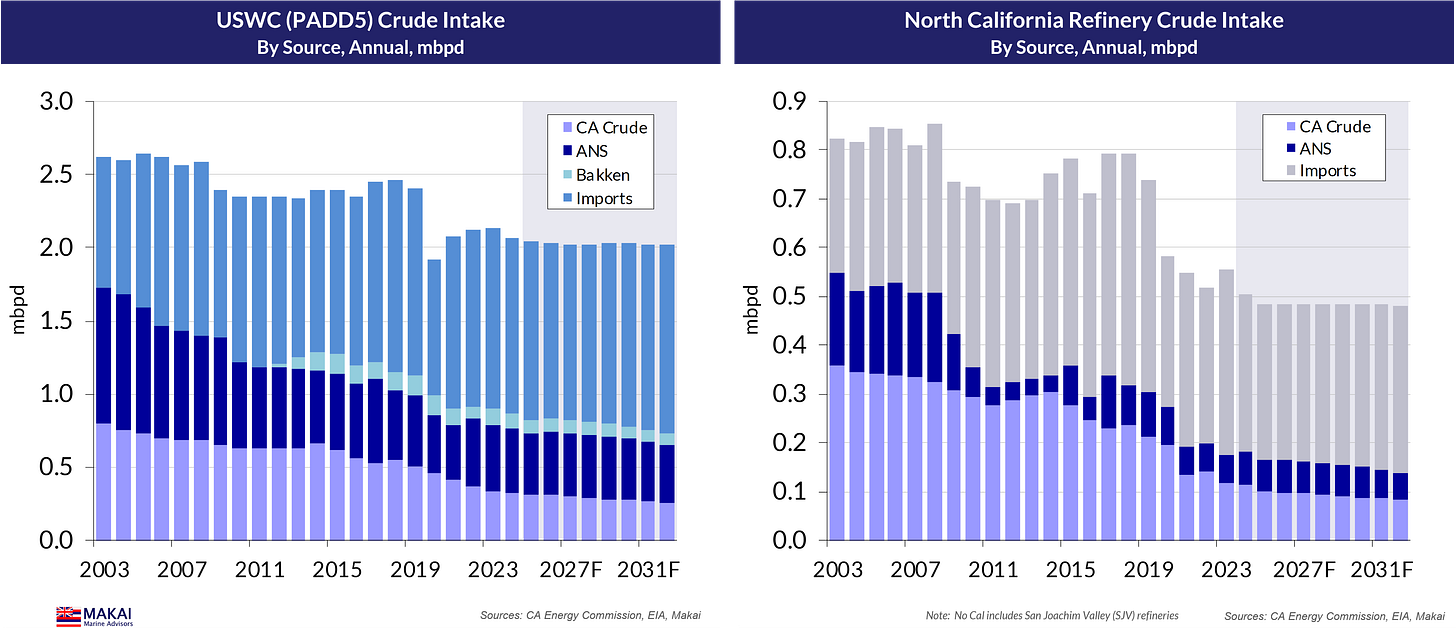

The key structural issue facing PADD5 refiners is the steady decline in domestic crude production and the need for rising imports to meet refining demand. As reflected below, the output of both Alaska North Slope (ANS) crude and Californian (CA) crude grades have been falling for decades, since peaking during the 1980s.

This structural decay has left PADD5 refiners with no choice but to import greater crude volumes to meet refining demand.

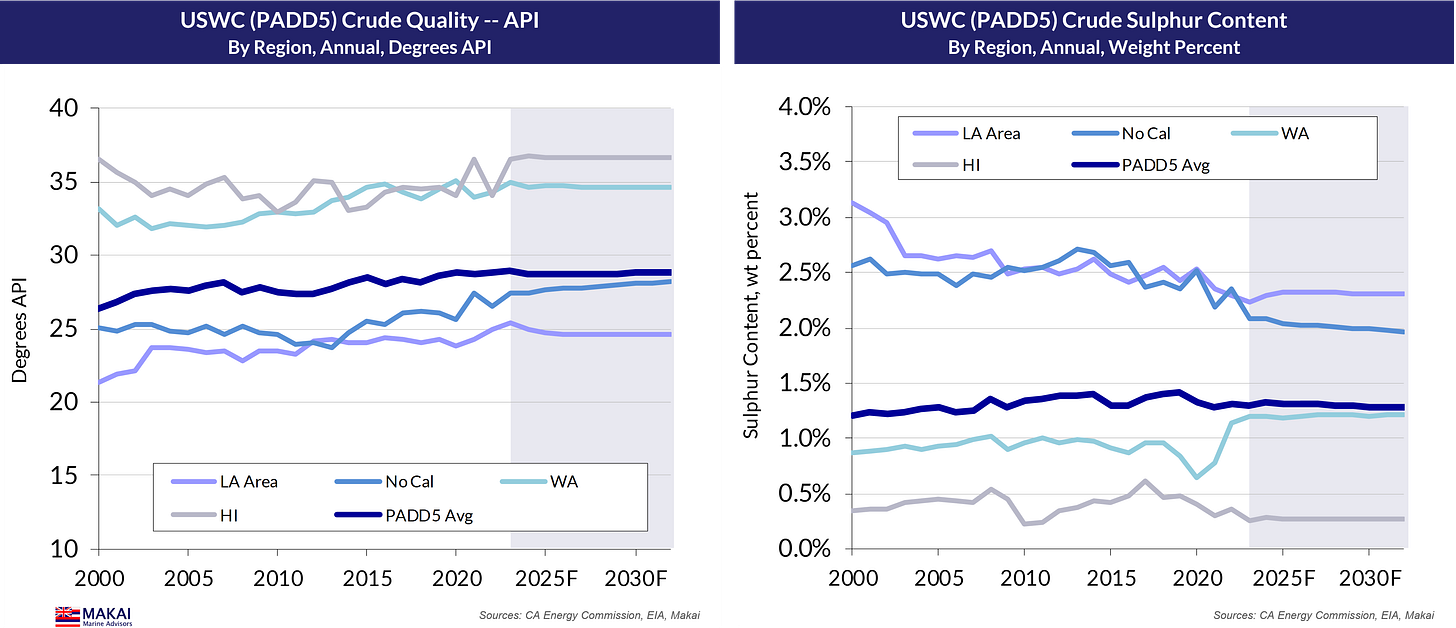

In addition to this volumetric challenge, the loss of each crude stream has presented quality issues for PADD5. ANS crude, with 32.1° API / 0.96% sulphur, has provided a lighter feed for less-sophisticated refineries, while CA crudes, with 12-15° API / 3.5-5.5% sulphur, have delivered vac resid for California’s coking refineries.

PADD5 refining regions and their varied crude slates

While the supply of heavy CA crude led to the construction of coking capacity in that state, each refining centre has followed its own development path. Washington state (WA) refineries have limited coking and hydrocracker capacity for their size, so the state has relied on ANS, Bakken and light crude imports from Canada. Hawai’i (HI) is an isolated market with an almost exclusively light/sweet crude slate, and it lost the 54 kbpd Ewa Beach refinery in 2020. Alaska is an even more isolated refining centre that processes about 100 kbpd of ANS crude, and is excluded from most of the analysis.

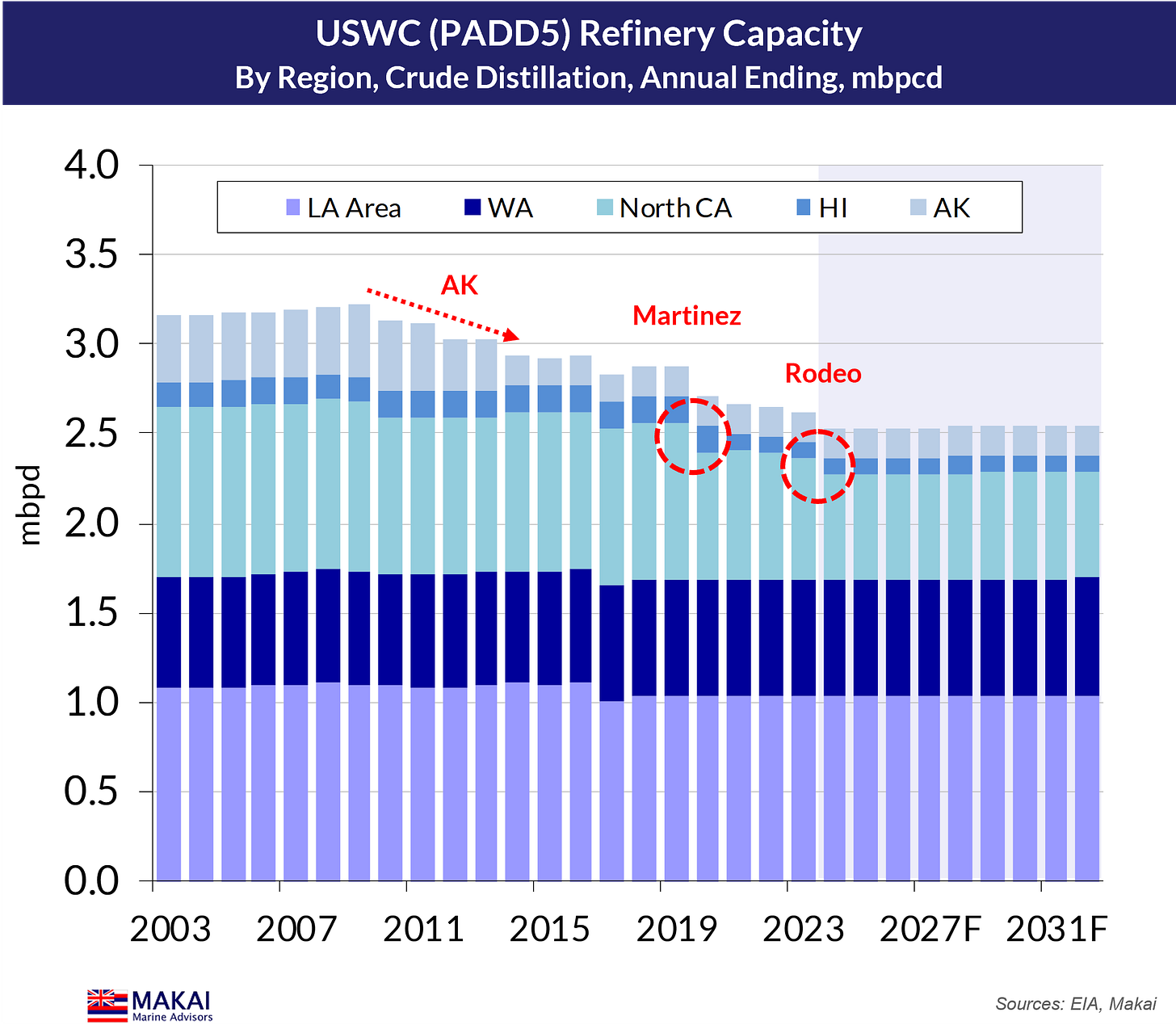

In addition to Ewa Beach, the Covid pandemic claimed two more PADD5 refining victims -- Marathon’s 161 kbpd Martinez refinery and the Phillips66 120 kbpd Rodeo plant. The owners have converted both refineries into renewable diesel facilities, but their closure also removed 104 kbpd of coking capacity. This has left the Bay Area as only a marginal destination for TMX crude.

Following the refinery closures, PADD5 is now processing just over 2 mbpd of crude.

Overall, the PADD5 crude slate looks balanced on crude quality, but this is deceptive.

The four refining centres have distinct crude intake slates, with LA geared towards heavy/medium and WA and HI running lighter crudes. The Bay Area slate is shifting lighter with the loss of its cokers.

The average API gravities and sulphur contents across PADD5 reflect each region’s crude slate.

They also reflect the relative roles of domestic crude in their intake slates. Washington has relied upon 100 kbpd of Bakken crude-by-rail to keep its slate light and sweet, while continued losses in ANS and CA crude have forced LA refiners to increase imports to meet demand.

As shown below, the Bay Area once took a greater share of CA crude by pipeline from the San Joachim Valley (SJV), but the loss of regional coking capacity has cut demand, leaving LA as the primary destination.

In fact, this shift in regional coking capacity and CA crude intake has also left LA as the only meaningful demand centre for heavy/sour crude, and the only viable candidate for importing TMX crude.

TMX offers a solution to an LA quandary

To an extent, LA does represent a new export market for Canadian producers, as WA refiners have long dominated the export flows from the TMP. For those producers, the opening of TMX comes at an opportune time, as exports into WA have reached the capacity of the 250 kbpd Puget Sound Pipeline that branches off of the TMP and delivers crude to four area refineries.

Equally opportune, in that TMX crude should allow LA refiners to meet a shortfall in the vac resid needed to keep its cokers running, as the decline in CA crude production removes a key source of that distillation cut. As shown in the simplified refinery process flow diagram below, vac resid is the heaviest cut from the vacuum distillation column. In sophisticated refineries, the vac resid flows to a coker or other resid upgrading unit; otherwise, it goes into fuel oil blending.

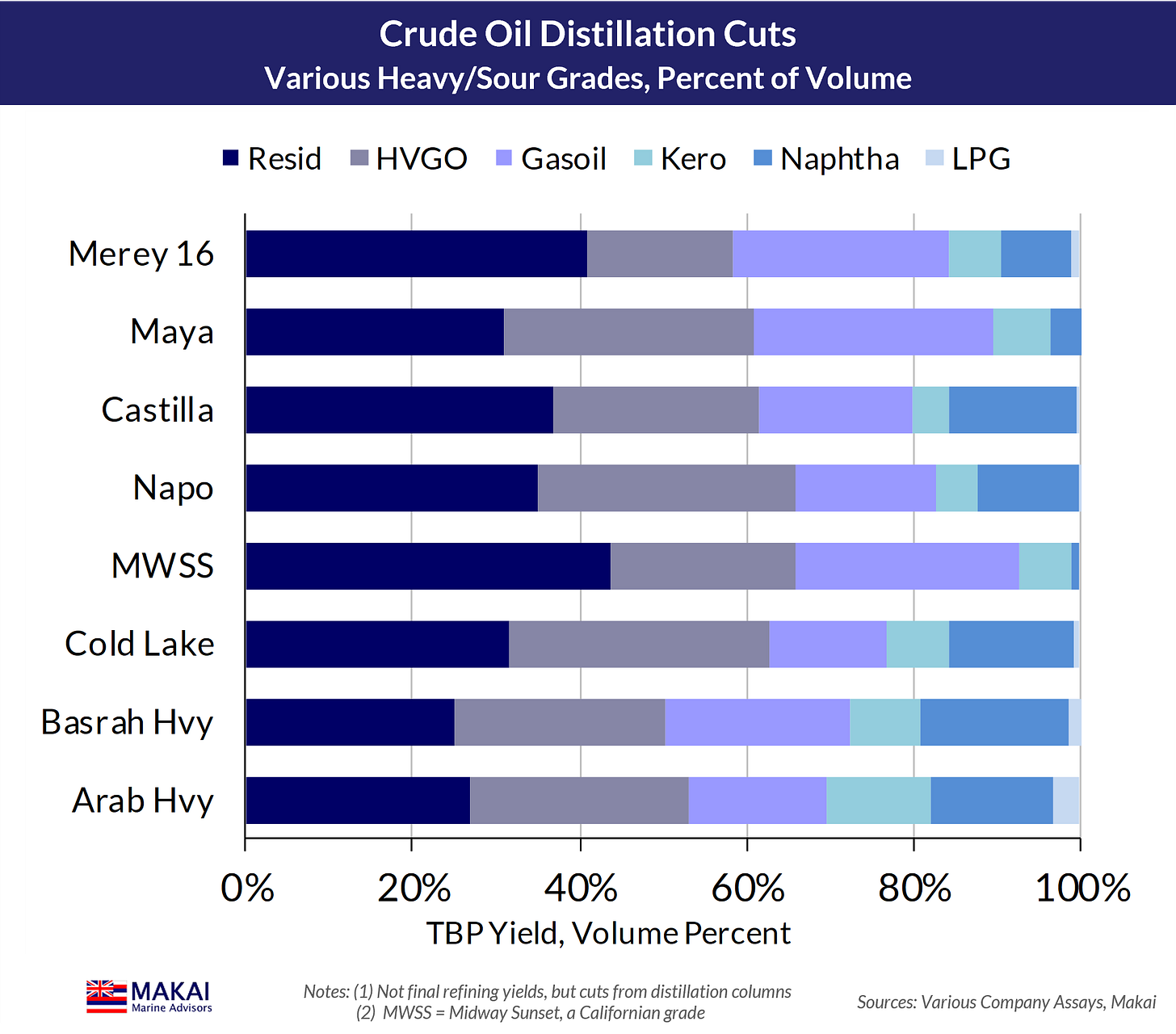

Heavier crudes will produce more vac resid, and the following chart shows the distillation cuts for various heavy/sour crudes that have played a role in the LA refinery slate.

The continued loss of CA crudes, with 37-44% vac resid yields, will eliminate a substantial portion of the LA refinery coker feed, and the chart below illustrates how imports into LA will need to provide an additional 25-30 kbpd of vac resid to keep the cokers running at the same levels.

Not surprisingly, heavy and medium crude imports have provided the vast majority of vac resid into LA (shown below), based upon detailed EIA cargo data and our crude assay database. The analysis uses a 565°C vac resid cut point on the vacuum distillation column, which can differ significantly between refineries, crude feeds and operating conditions. The process is not exact, but the estimated volumes have correlated well.

Also, as shown above, heavy/sour imports will need to provide a larger proportion of vac resid into LA refineries, relative to medium grades. Replacing CA crudes, with higher vac resid cuts, with Canadian Cold Lake crude, with a 31% yield, requires greater heavy/sour import volumes to compensate.

The above chart illustrates the potential TMX import volumes into the LA area refineries, required to meet coker demand. Although TMX crude could theoretically displace Ecuadorian (ECU) and Colombian (COL) crude, subject to contractual obligations, a much larger constraint looms.

Too much sulphur

Although TMX crude would bring welcome vac resid volumes to LA, the 3.75% and 4.01% sulphur content of Cold Lake and Western Access Blend (AWB) crudes, respectively, would strain the desulphurisation capacity of area refineries.

In comparison, the heavy COL and ECU grades have 1.8-2.1% total sulphur. For this reason, these crudes must remain in the LA slate, or the sulphur from TMX crudes would add excessive pressure on desulphurisation capacity.

We have constrained TMX volumes to keep LA refinery sulphur intake to levels with previous years, from an analysis based upon total sulphur coming into the refining system.

This sulphur balance for LA refineries also requires a reduction in 3% sulphur Basrah Medium from the slate to accommodate TMX crude and keep sulphur levels in check.

On this basis, LA refinery imports of TMX crude would be limited to 140 kbpd by 2032, or 120 kbpd more than previous TMP imports, bringing the TMX share of heavy/sour imports to 46%.

With an additional 10 kbpd of TMX crude that could fit into the Bay Area crude slate, PADD5 could see as much as 170 kbpd of heavy/sour crude imports from Canada by 2032. This would represent a 130 kbpd increase from TMP levels, as an indication of incremental TMX volumes.

Predictable Tonne-mile Impact

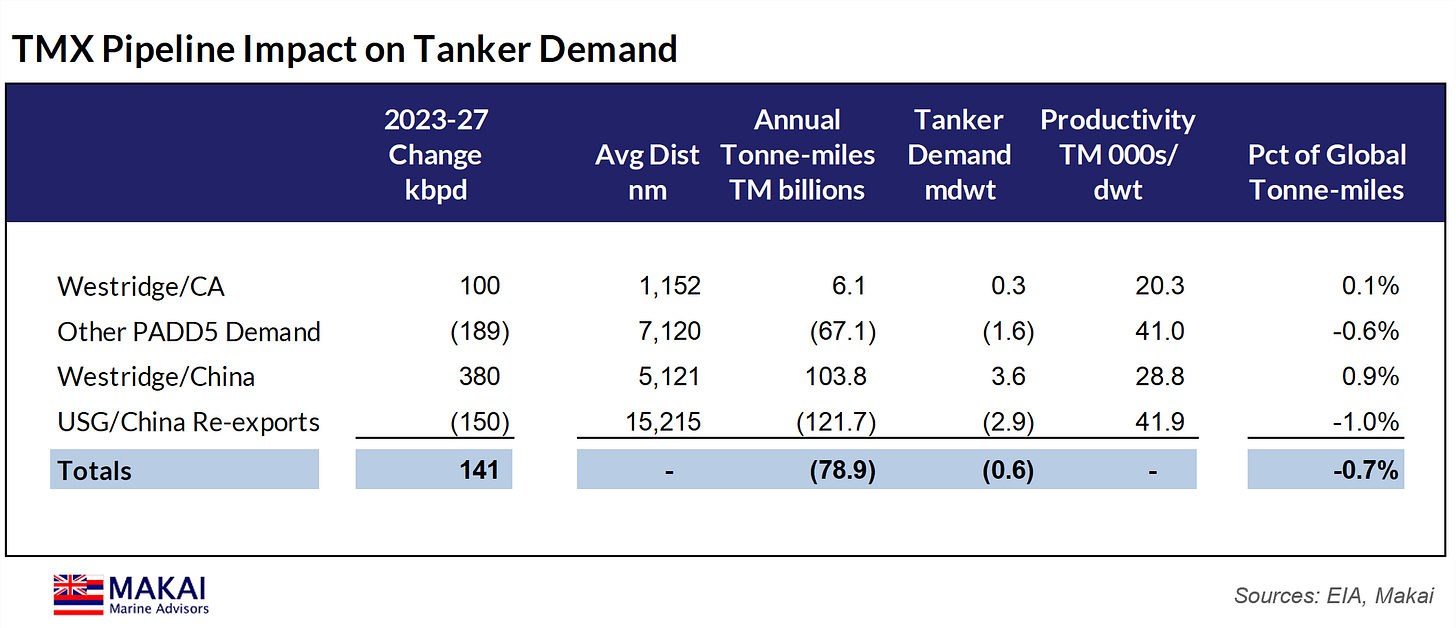

The emergence of TMX crude 1,185 nm away from LA, and its displacement of medium/sour Mideast grades, would cut PADD5 crude tonne-miles by 15% through 2027. This 61 billion tonne-mile (btm) decline would also leave PADD5 tonne-miles 15% below demand that would have occurred without TMX.

Importantly, this drop in PADD5 crude tonne-miles offsets 60% of the increase in demand from TMX crude sailing to China by 2027.

Considerable uncertainty surrounds when the TMX will reach its 590 kbpd capacity, as it depends upon Canadian production gains. Under modest 80-100 kbpd annual growth assumptions, the pipeline would begin to hit capacity by end-2027. For the year, this would imply 100 kbpd of PADD5 imports and 380 kbpd of exports to Asia, which would generate a combined 110 btm of new demand.

With the majority of Canadian exports committed to Midwest and USG refiners, the obvious choice for redirected Canadian production into the TMX is the 150 kbpd of Canadian re-exports to China via the USG during the past year. After this, the TMX fills on incremental Canadian production. This initial shift in Canadian flows would remove 122 btm of demand, predominantly for VLCCs.

The net tanker demand impact would be minus 79 btm, or 0.7% of global demand.

Conclusions

Although continued concerns surround the start-up of the TMX pipeline, it will eventually provide the first increase in Canadian pipeline egress since the 2021 Enbridge Line 3 replacement project. Moreover, TMX will finally give Canadian producers meaningful access to Pacific markets, and an alternative to their exclusive embrace with US refiners.

Just exactly to where in the Pacific that TMX crude flows has been a contested topic amongst tanker market participants. Our analysis suggests that the USWC is unlikely to represent much more than 20% of TMX flows, as desulphurisation and other refining constraints will keep imports limited to 130 kbpd.

The net tanker demand impact of -0.7% of global tonne-miles is a reminder that shipbrokers and the sell side will always emphasise the isolated increases in tanker demand from an oil market event, but will never consider or even mention the offsetting flows.

Tremendous work on this, Jeff—by far the most detailed and thoughtful treatment of the subject I've seen to date.

Great write-up, thanks.