A stay of execution?

Abrupt shifts in the demand growth of two product grades may offer hope for the beleaguered European refining sector

Gloom has surrounded the European refining sector for decades, from a litany of issues -- most notably, its small-scale cracking refineries trying to compete in a hydrocarbon world increasingly dominated by large coking and petrochemical-oriented plants. Add higher energy costs and collapsing crack spreads to the mix, and the sector gestalt has all the emotional buoyancy of a walk down Death Row.

Indeed, that is where most industry observers are placing the sector, with expectations of further refinery closures, now that the Russian-inspired margin bonanza has ended. Net Zero narratives are adding to the calls for execution, based upon expected disappearing fuel demand from aggressive electric vehicle (EV) adoption.

Of course, this should be the first clue that the trajectory for European refining could stray from the popular narrative pathway. Some of the forces buffeting that trajectory:

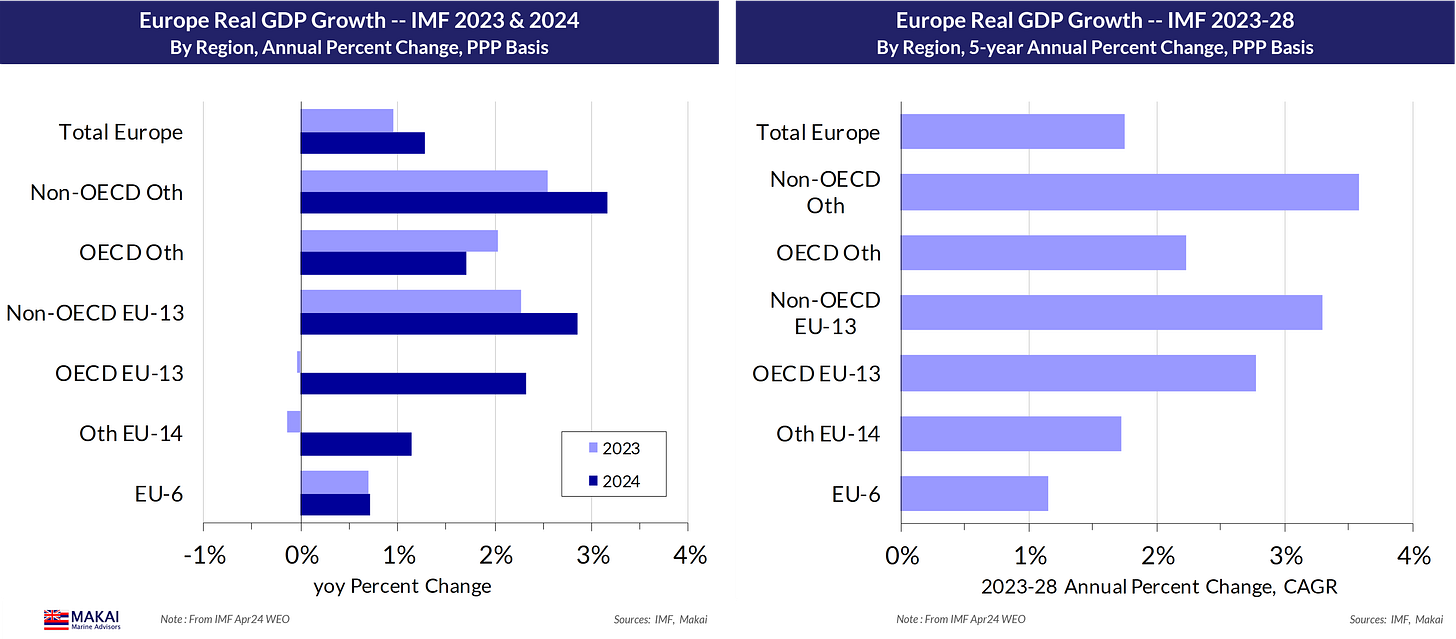

European macro continues to struggle – A lingering manufacturing recession in core Europe is delaying expectations for a sustained macroeconomic recovery, as the IMF has lowered forecasts for 2024. Faster growth in the EU-13 and non-OECD Europe is offsetting the core Europe malaise.

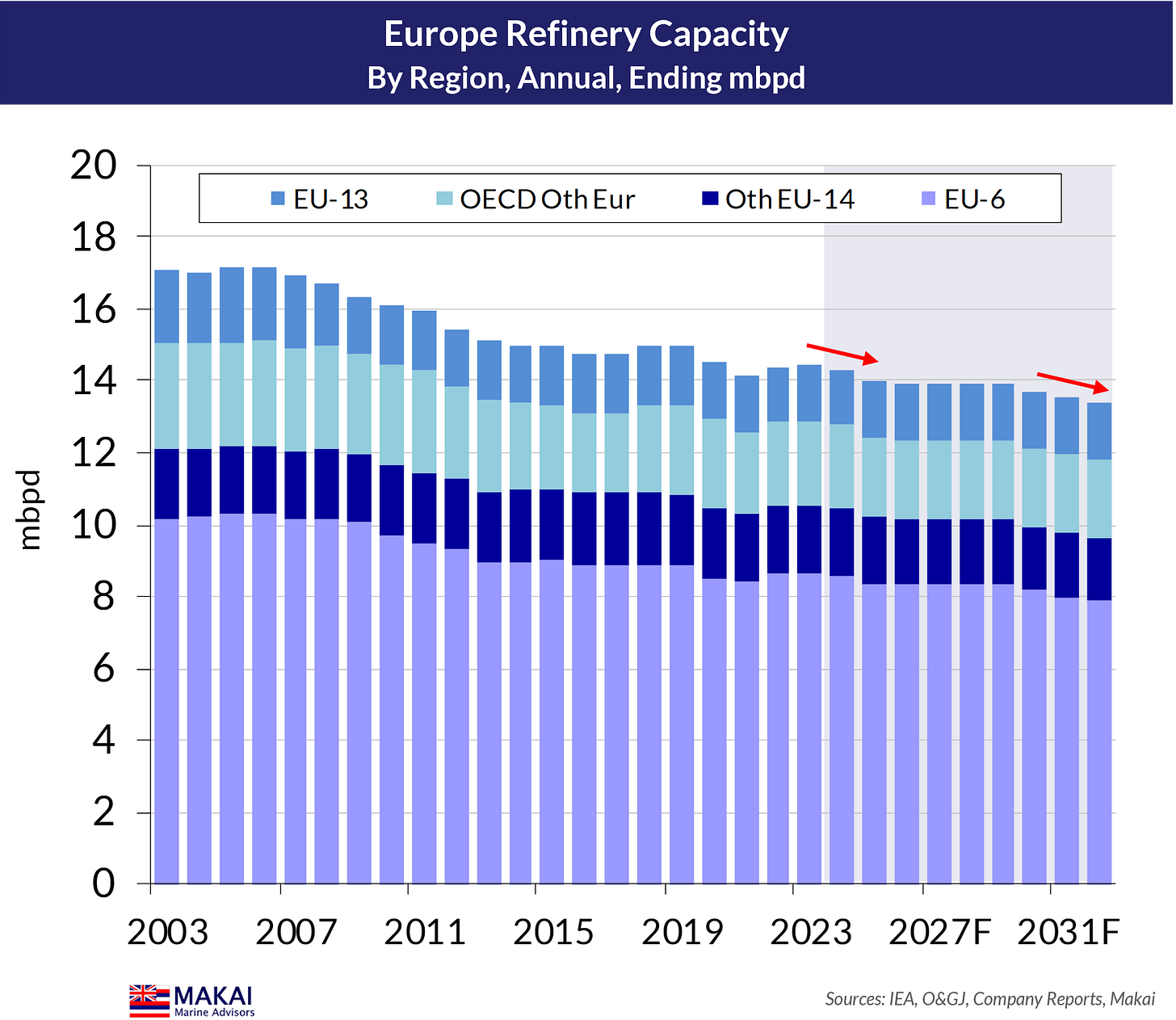

More refinery closures – Refiners have announced 2025 closures for three facilities in Germany and the UK, with a combined capacity of 380 kbpd. Although these shutdown headlines add to the sector gloom, an expected tightening in global refining balances from 2027 could support regional refining.

Gasoline demand reversal – After declining for two decades, petrol consumption has abruptly changed direction, with 5% yoy gains in 2023 and 1h24. A sales shift in internal combustion engine (ICE) vehicles from diesel to petrol and robust sales of gasoline Hybrid EVs (HEV) have driven these gains.

De-dieselisation – European consumers have ended their love affair with diesel cars that took the diesel share of the fleet to 42%. EU registration data is showing 10% yoy declines in sales, while the share of registrations has plunged to 11-12%. With anaemic macro conditions limiting trucking demand, this shift has cut diesel demand and import requirements.

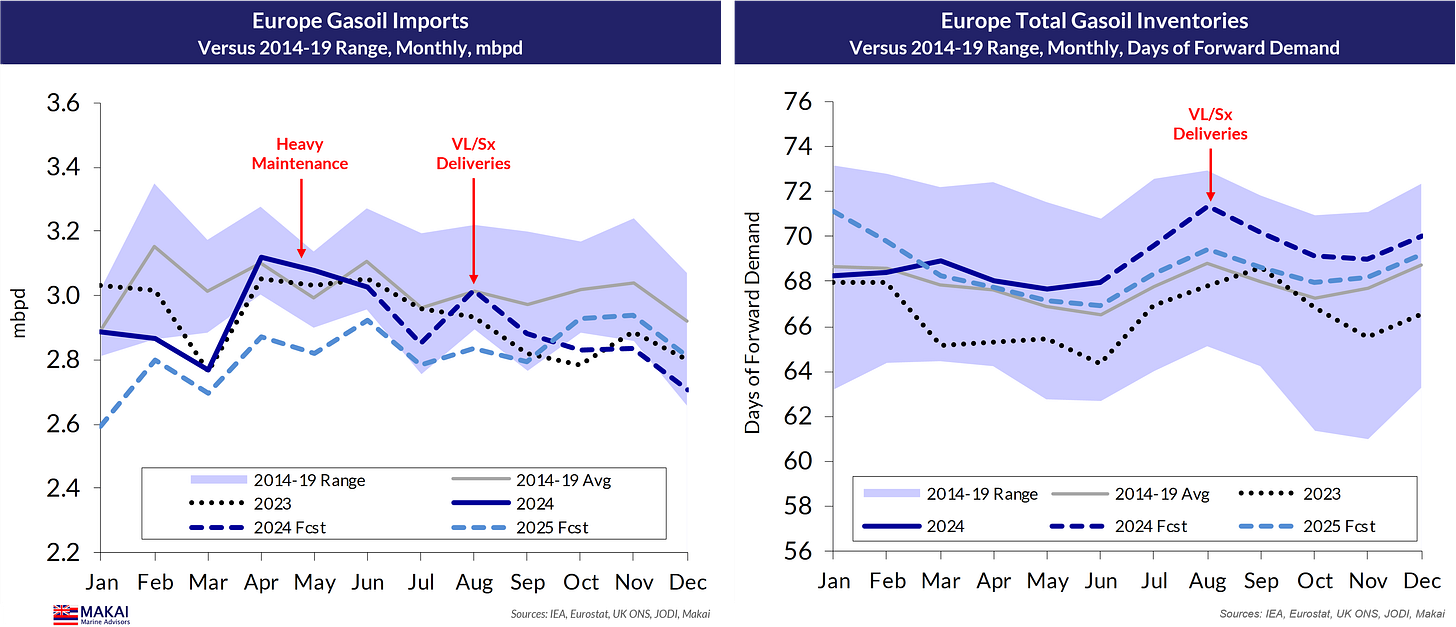

In the near term, with cleaned-up VLCCs and Suezmaxes now delivering lumpy, outsized parcels of gasoil to Europe, de-dieselisation is likely to drive underwhelming gasoil imports this winter. Let’s take a look at what our 34-country refining mass balance models are saying about the direction of European refining.

European Macro: still awaiting salvation

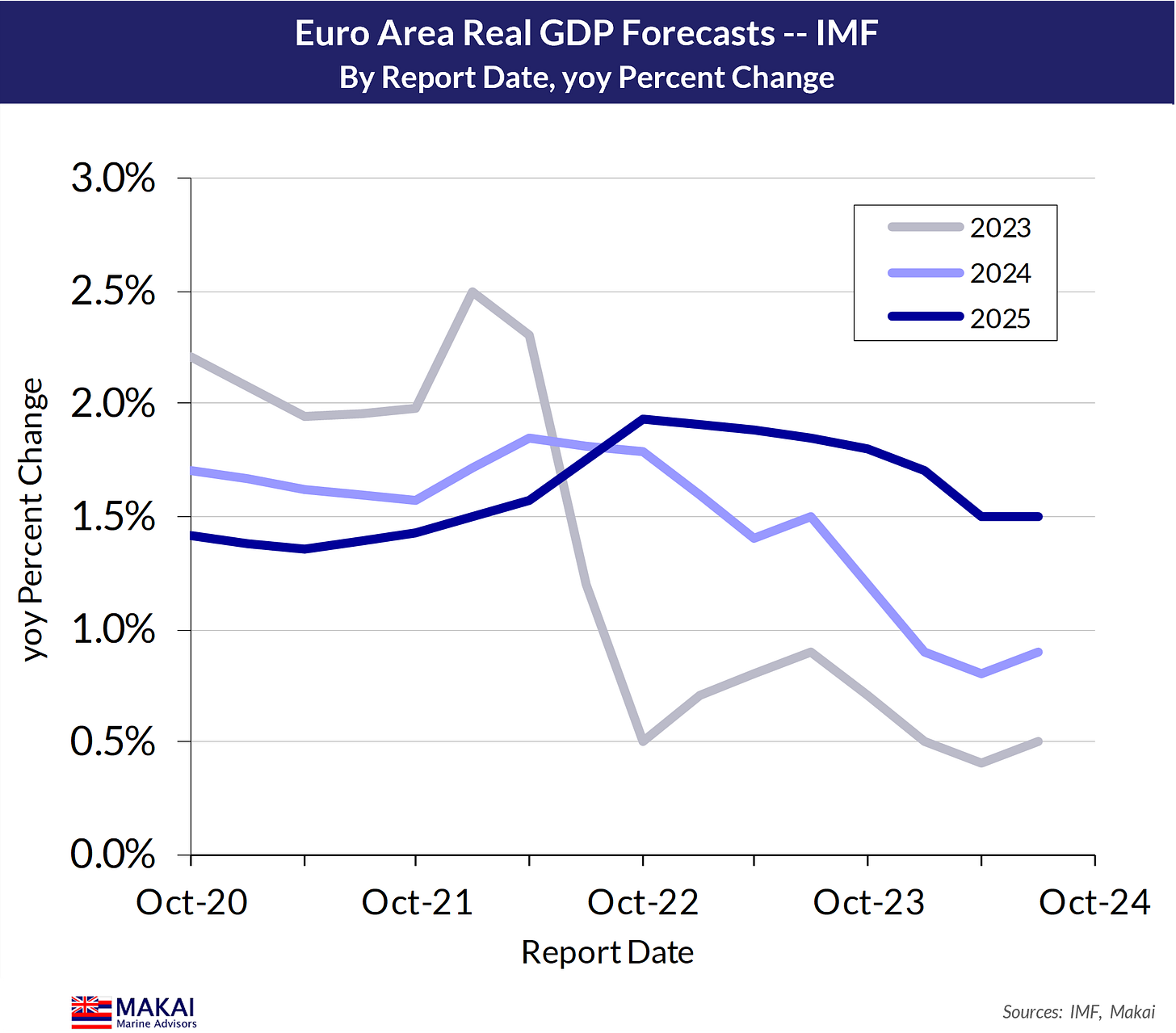

Anaemic economic activity in Europe continues to thwart hopes and expectations for a sustained macroeconomic recovery for the region. Core Europe, led by Germany, continues to disappoint, while mired in a manufacturing recession. This sub-region’s woes are reflected in the following chart of IMF forecasts for Eurozone real GDP growth, with successive reductions in the agency’s outlook for 2024.

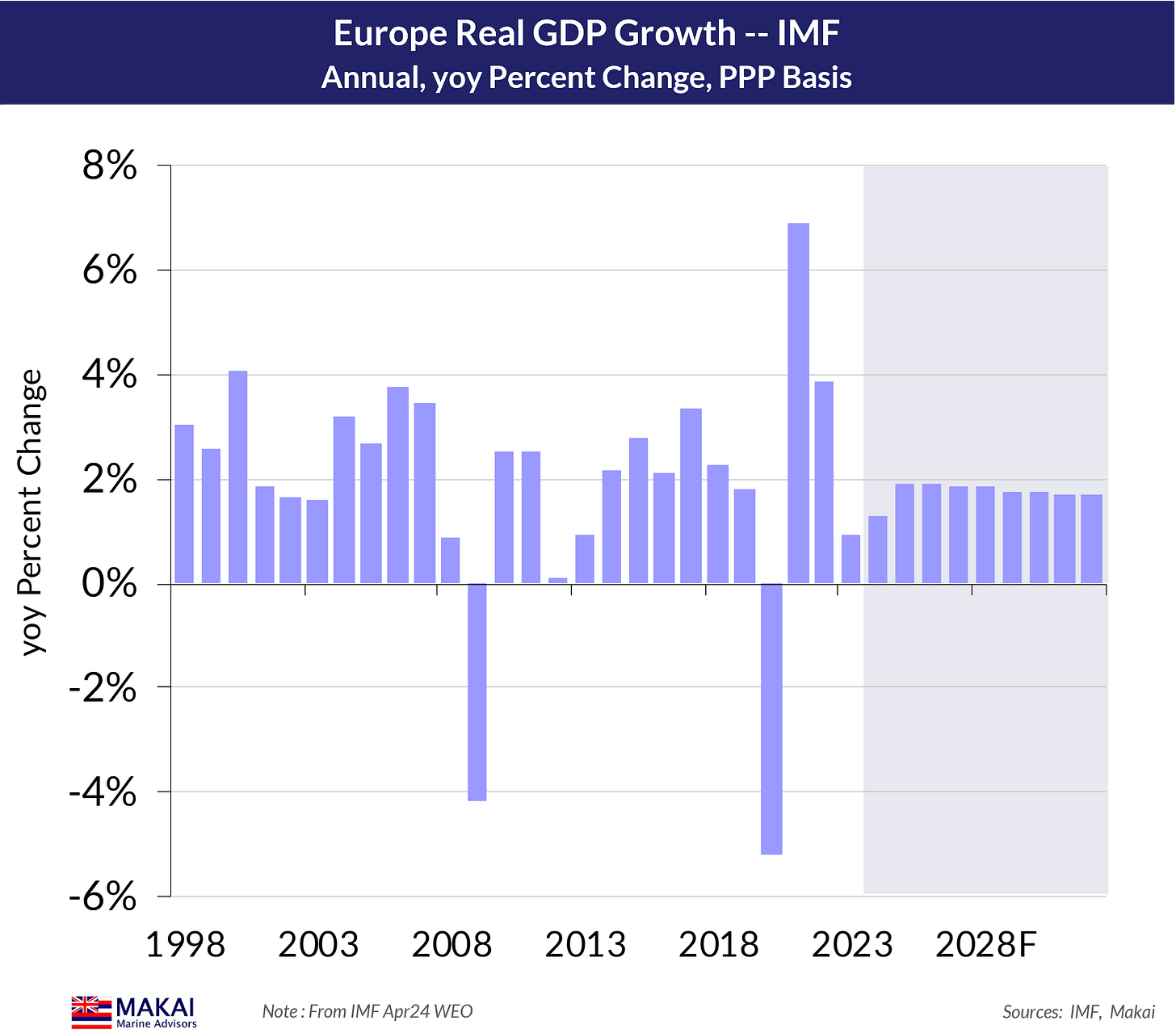

In its typical cheery fashion, the IMF has delayed the anticipated Eurozone rebound until 2025, with total European growth accelerating to 1.9% (below).

Still, this year’s anticipated uptick in real GDP growth to 1.3% is heavily reliant upon a sharp recovery in certain OECD elements of the EU-27 (lower left).

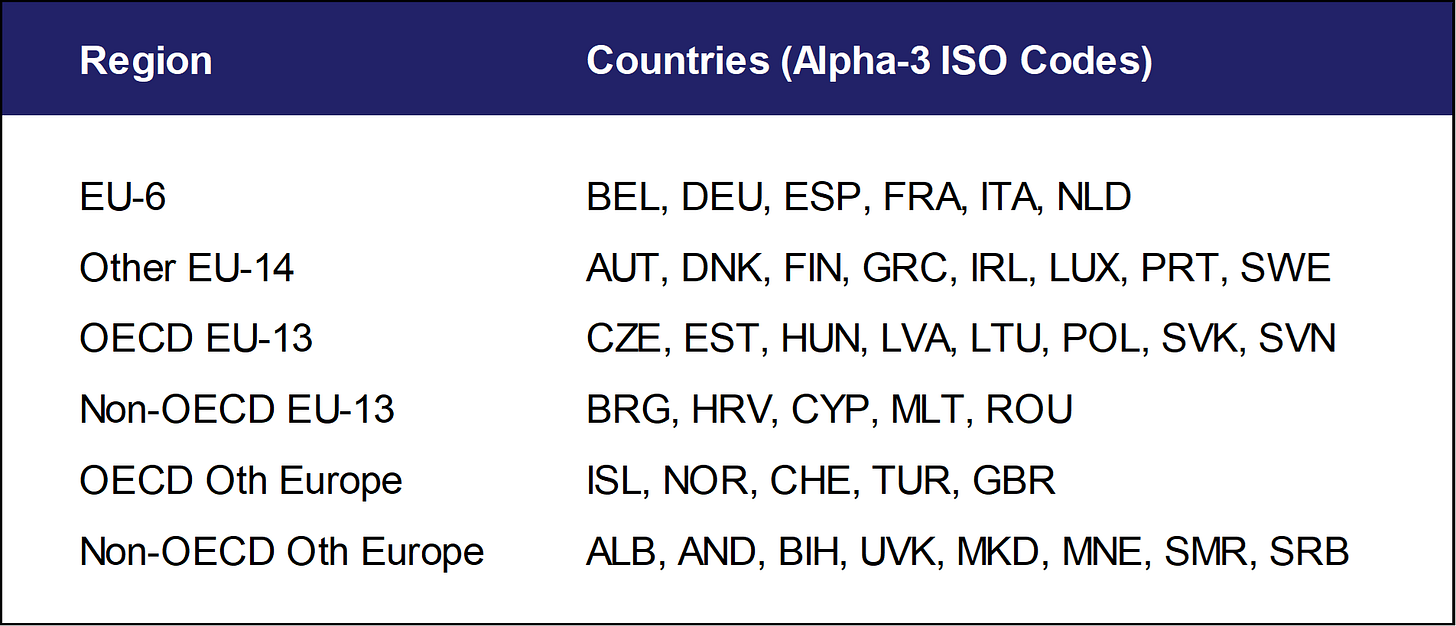

Over the next five years, Non-OECD Europe will drive regional growth, although the IMF expects OECD EU-13 to return to its earlier, rapid growth path. OECD Other Europe is led by Turkey, but held back by the other, less-dynamic elements of core Europe in the group (table below).

European Refinery Closures: a never-ending saga?

As global refining margins eased from their post-Ukraine invasion highs, and now, have spiralled lower on macro fears, the perennial debate on the future of European refining has reemerged. The tone is always dour, and somewhat well deserved, given the smaller-scale cracking refineries that dot the regional landscape. They cannot compete with larger, more-sophisticated coking refineries in the AG, and those emerging in the Atlantic Basin (e.g., Dangote, Dos Bocas).

So the recent announcements to close three refining facilities with a combined capacity of 380 kbpd are not terribly surprising:

Shell plans to stop crude processing at its 147 kbpd Wesseling refinery at the 340 kbpd Rhineland complex during 2025, and is turning the hydrocracker there into a base oil plant.

BP has announced plans to permanently close a third of the crude distillation capacity at its 257 kbpd Gelsenkirchen refinery in 2025. They have not disclosed whether it will be a CDU at the Scholven or Horst section of the refinery. The refinery hydrocracker will start co-processing biofuels.

INEOS is preparing to close its 150 kbpd Grangemouth refinery in Scotland in 2q25, and convert the site into a product import terminal.

These announcements follow this year’s conversion of ENI’s 84 kbpd Livorno refinery into a biofuels facility, implying 460 kbpd of total European capacity losses for 2024-25, or about 3% of the total.

Some forecasts for growing EV penetration has also contributed to the downbeat outlook for European refineries, by curtailing gasoline demand expectations, the primary product from cracking refineries. Meanwhile, the regional macro gloom has supressed expectations for diesel demand, leading the IEA to forecast a potential 1.0-1.5 mbpd of European refinery closures through 2030.

Resurgent gasoline demand not following the Net Zero script

Of course, this is the same IEA that expects EV penetration to displace an incremental 5 mbpd of global fuel demand by 2030, including a 12% plunge in European gasoline demand by then. Much of the agency’s Net Zero-driven forecast is based upon significant market penetration of battery electric vehicles (BEV), followed by plug-in hybrid vehicles (PHEV) and hybrid vehicles (HEV).

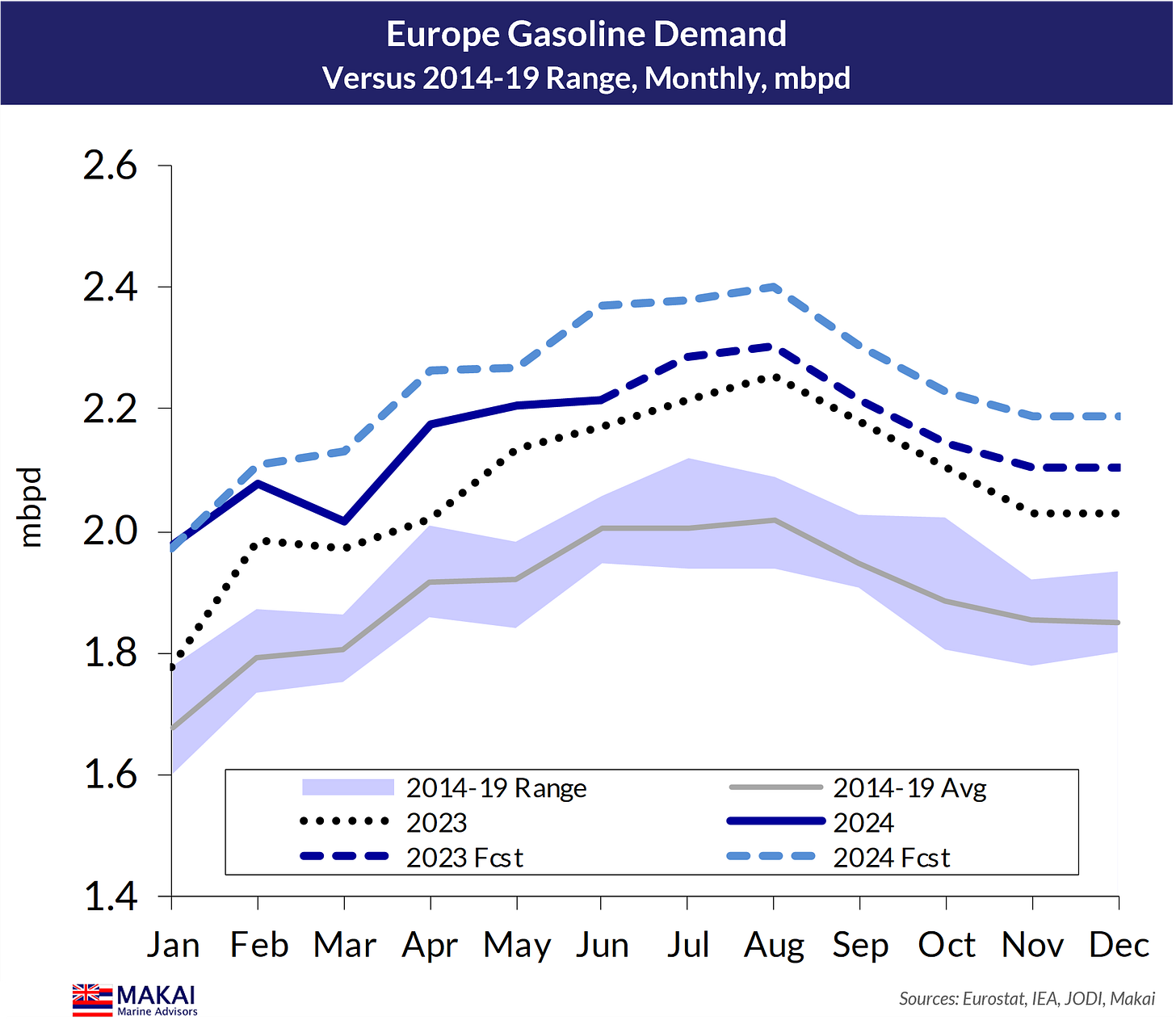

Apparently, European consumers have different buying ideas, and the July 2024 EU car registration data from the European Automotive Manufacturers’ Association (ACEA) was a stark reminder of the power of consumer preferences over policy wishes. BEV sales fell by 10.8% yoy, while PHEV registrations crashed by 14.1%. In contrast, sales of HEVs leapt by 25.7% yoy in July, suggesting interest in EVs, but lingering concerns over range and charging infrastructure.

Sales of ICE vehicles fell by 7.8% yoy, led by a 10.1% decline in diesel vehicles, as drivers continue to shun them. With a small 1.3% ytd decline in petrol ICE sales, combined with the jump in mainly petrol HEV registrations, European gasoline demand has jumped 5.0% yoy during 1h24 (below).

We expect some deceleration in the coming quarters, but no near-term reversal in petrol demand growth, as these vehicle buying trends should continue, until consumers receive some sort of oil price impulse for BEV/PHEV adoption.

Even with some slowing in gasoline oil intensity (right above), petrol demand per capita should remain well above the IEA’s demand forecast in its Oil 2024 report (left).

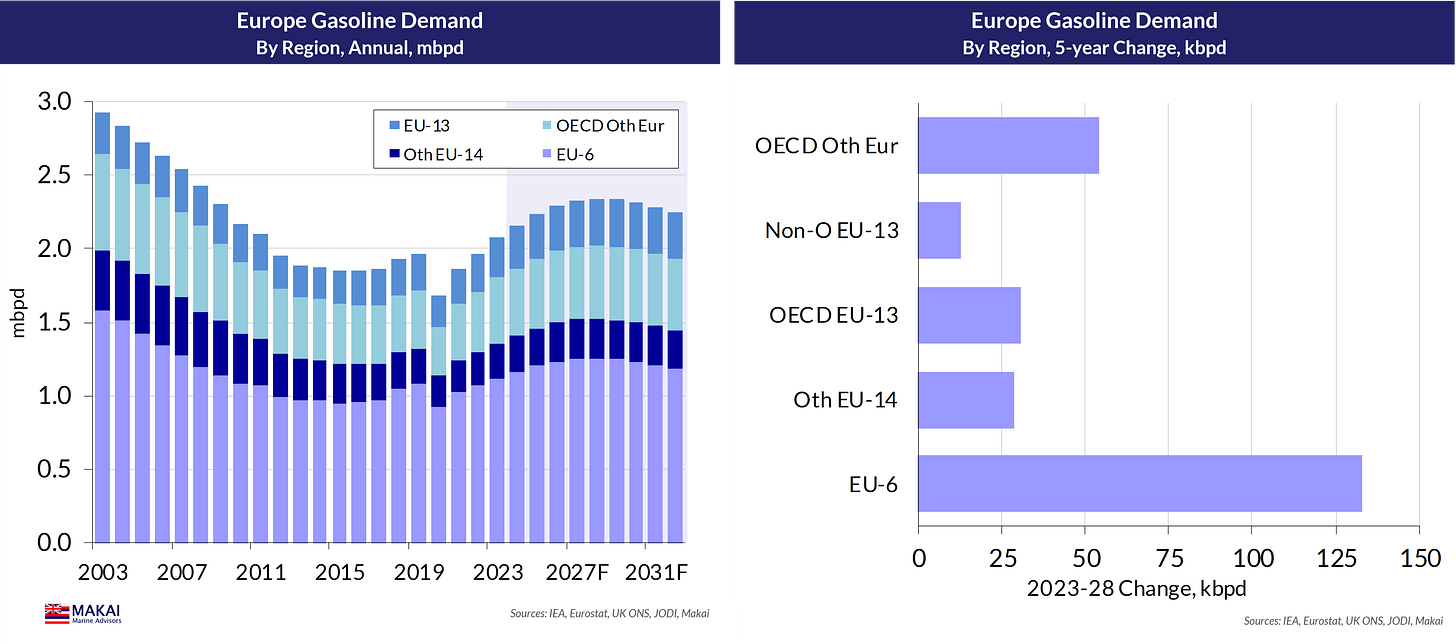

The type of power source in European auto sales varies dramatically between countries, but given the relative size of automotive fleets and petrol demand, core Europe is set to provide the bulk of the gasoline demand growth in Europe.

Another prospective threat to European refining via gasoline markets is the delayed emergence of the 650 kbpd Dangote refinery in Nigeria. Dangote built the refinery to cut Nigeria’s and West Africa’s (WAF) 800 kbpd import dependence, long dominated by petrol deficits. So, Dangote is focused on gasoline production, featuring its massive 247 kbpd resid FCC, and should cut petrol imports by more than 200 kbpd by 2026. Since 85% of these imports are sourced from Europe, the argument is that the loss of this export market will weaken refining margins and pressure more refinery closures.

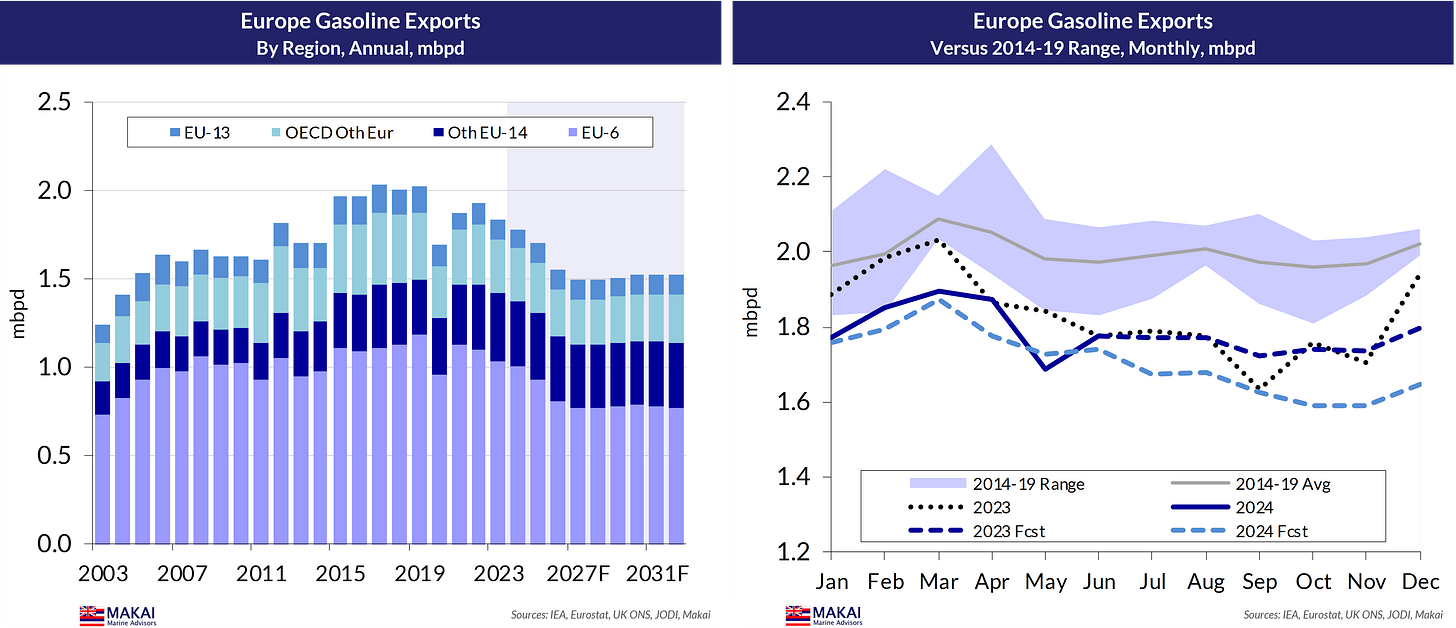

The surprising jump in European gasoline demand, however, is undercutting that narrative, along with announced refinery closures. Forecast regional gasoline balances show that declining gasoline production should cut petrol exports for the next few years, before stabilising from slowing demand and renewed refinery closures after 2029 (below).

In fact, European gasoline exports are poised to fall as much as 350 kbpd through 2027 (below left), with declines accelerating in 2h25 with refinery closures.

As the Dangote RFCC ramps up throughput during 2025, European gasoline exports will have fallen by a similar amount as the loss of WAF petrol imports. Some elements of the “Dangote will wreak Atlantic Basin refining” narrative may be overblown, although the refinery should eliminate 1% of clean tanker demand.

Diesel: you lost that loving feeling

Europe began its fondness for diesel-powered cars decades ago, but it accelerated in the 2000s, with the diesel share of the automotive fleet rising from 27.1% in 2005, to 42.0% in 2016. At this point, the ramifications of the “Dieselgate” emissions cheating scandal took hold on the market, and the dieselisation ardour cooled. In the latest ACEA car fleet figures for 2021, the diesel share still sat at 41.9%, but based upon slipping registration figures, the diesel share should be close to 38.5% by year-end 2024, with a 4.5% decline in the diesel fleet since 2021.

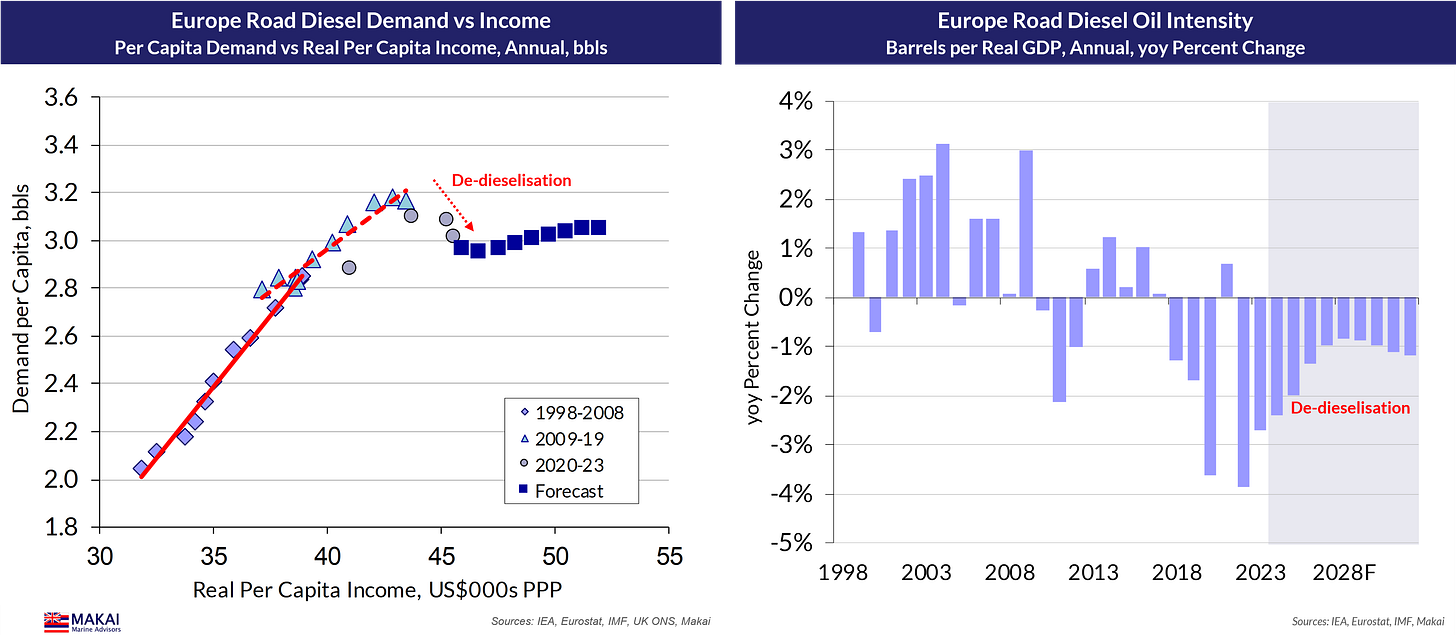

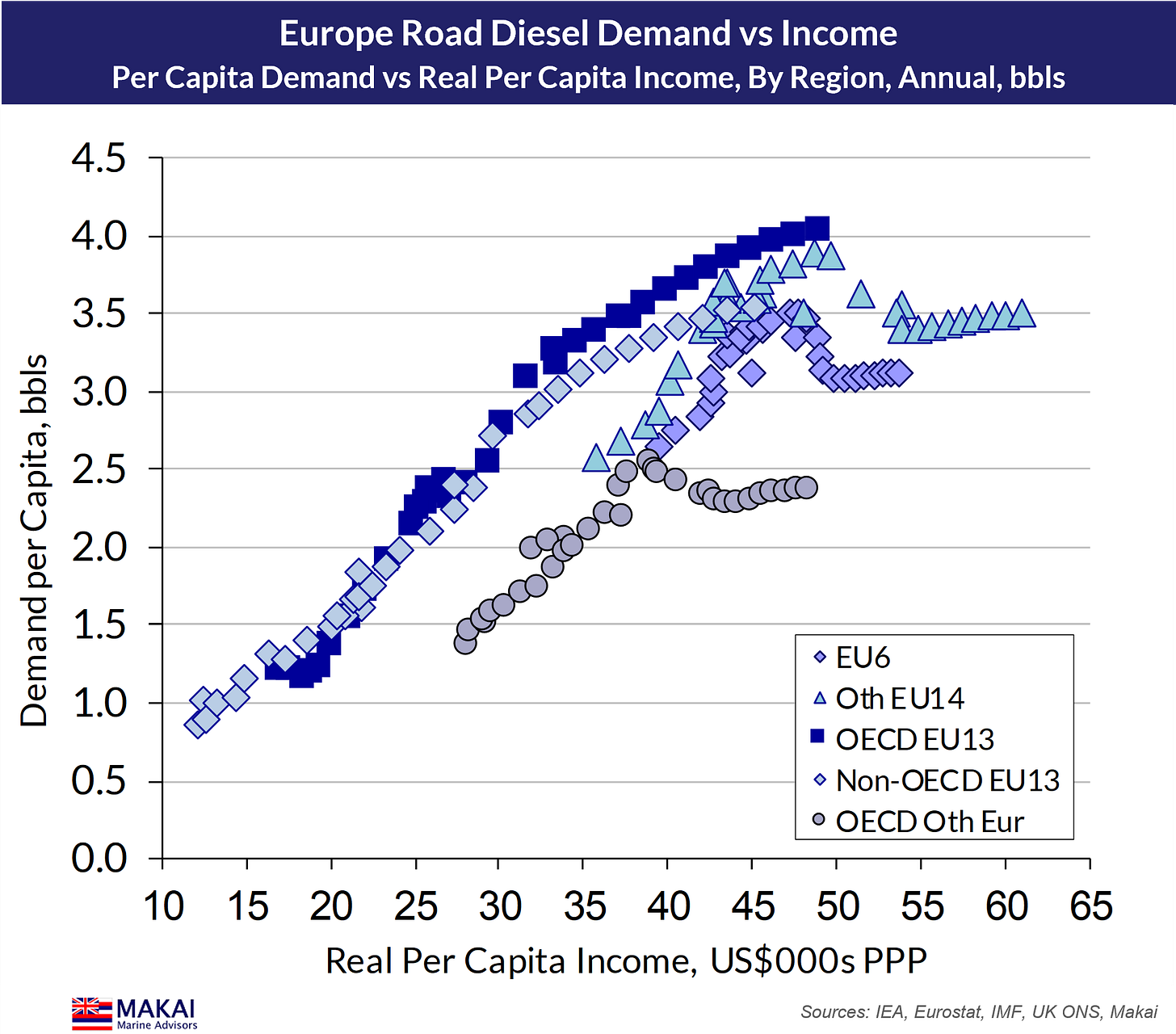

With this messy diesel divorce, European drivers have upended a long-standing relationship between income and diesel demand, which typically shows a linear income elasticity from rising freight traffic from growing industrial production and consumer spending (above). This de-dieselisation is occurring during a period of weak economic growth, and a divide between manufacturing activity and services, allowing the diesel passenger fleet decline to exert more pressure on regional diesel demand. Ultimately, any macro recovery will allow trucking demand to reassert itself, albeit with a reduced income elasticity, assuming that diesel car registrations remain near their current 12% share.

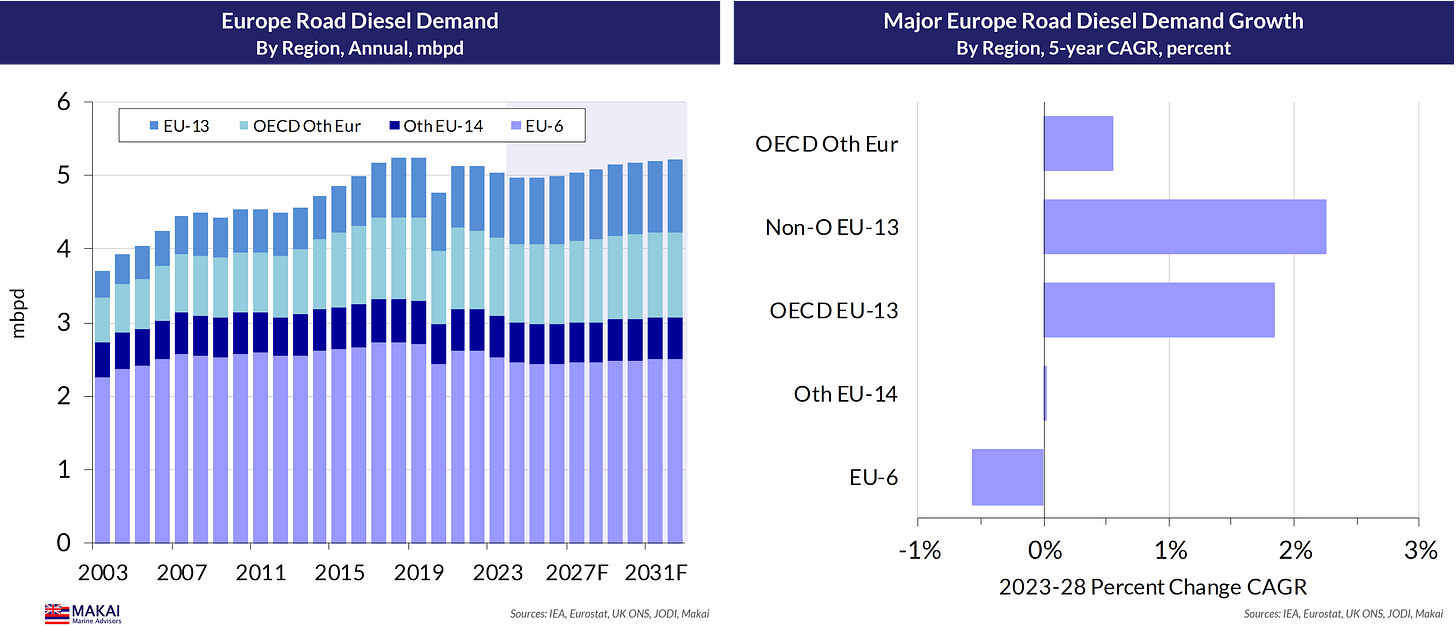

This dynamic plays out in regional demand differences, in which the faster-growing EU-13 economies (and Turkey in OECD Other Europe) drive much higher trucking diesel demand growth than core Europe, offsetting more modest de-dieselisation in those countries.

This is also evident in the above chart, in which the EU-13 countries continue their diesel income elasticity from rapid growth, while core Europe shows the de-dieselisation jolt downwards.

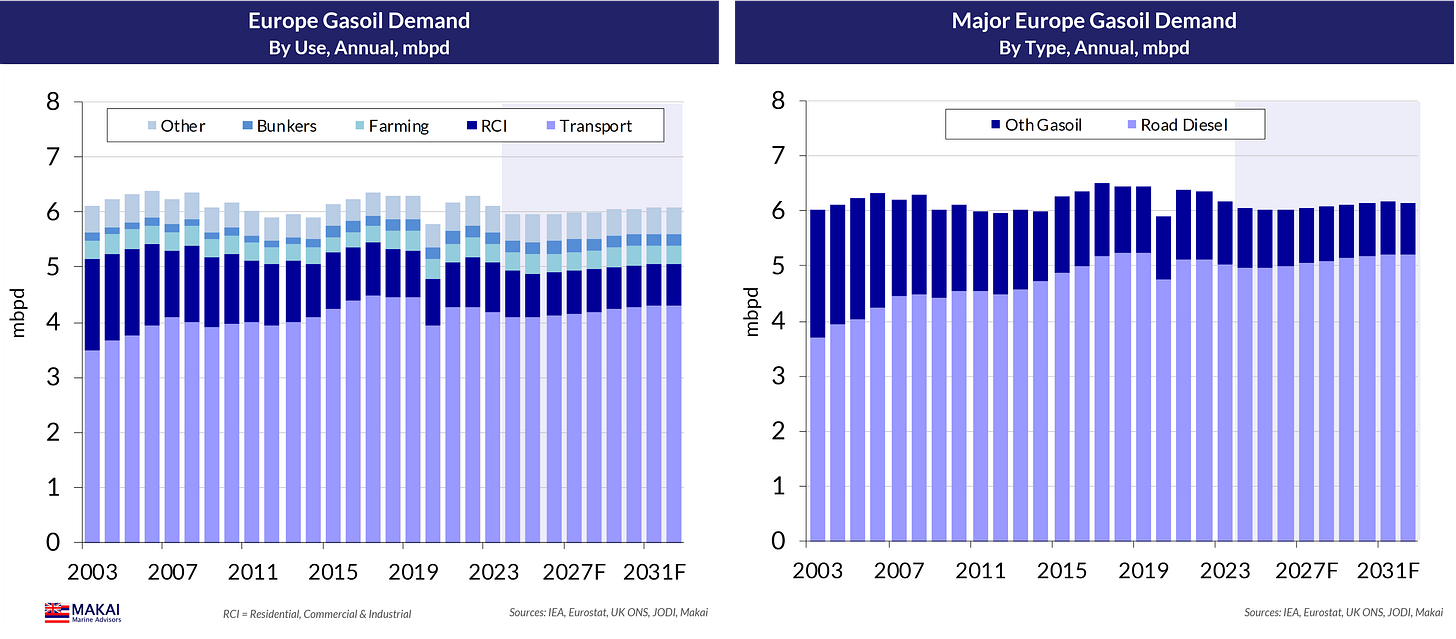

With renewed declines in other gasoil demand, as heating oil use continues to slip, total gasoil consumption should slide through 2026, before recovering modestly.

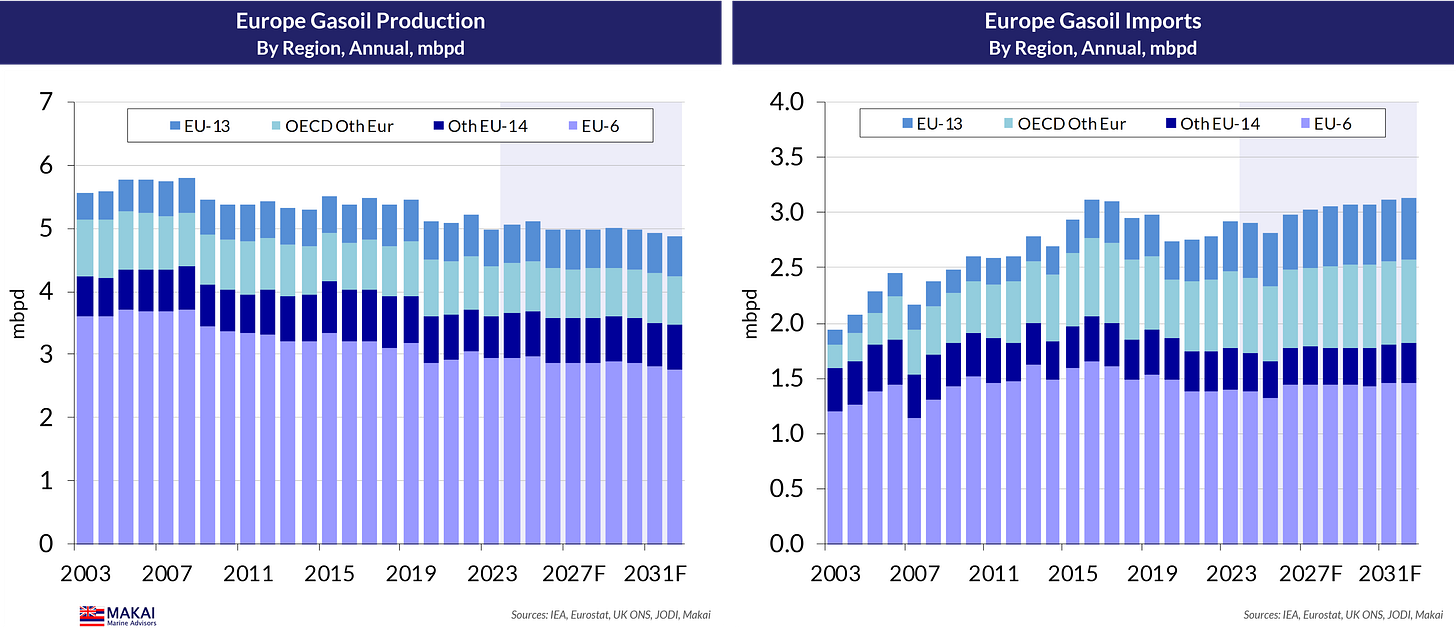

With a decline in gasoil production from the 2025 refinery closures in Germany and the UK, European gasoil imports take a 170 kbpd jump higher in 2026. Without the recent de-dieselisation, however, imports would be 350 kbpd higher in 2026, or the equivalent of 24 extra LR2s from the AG.

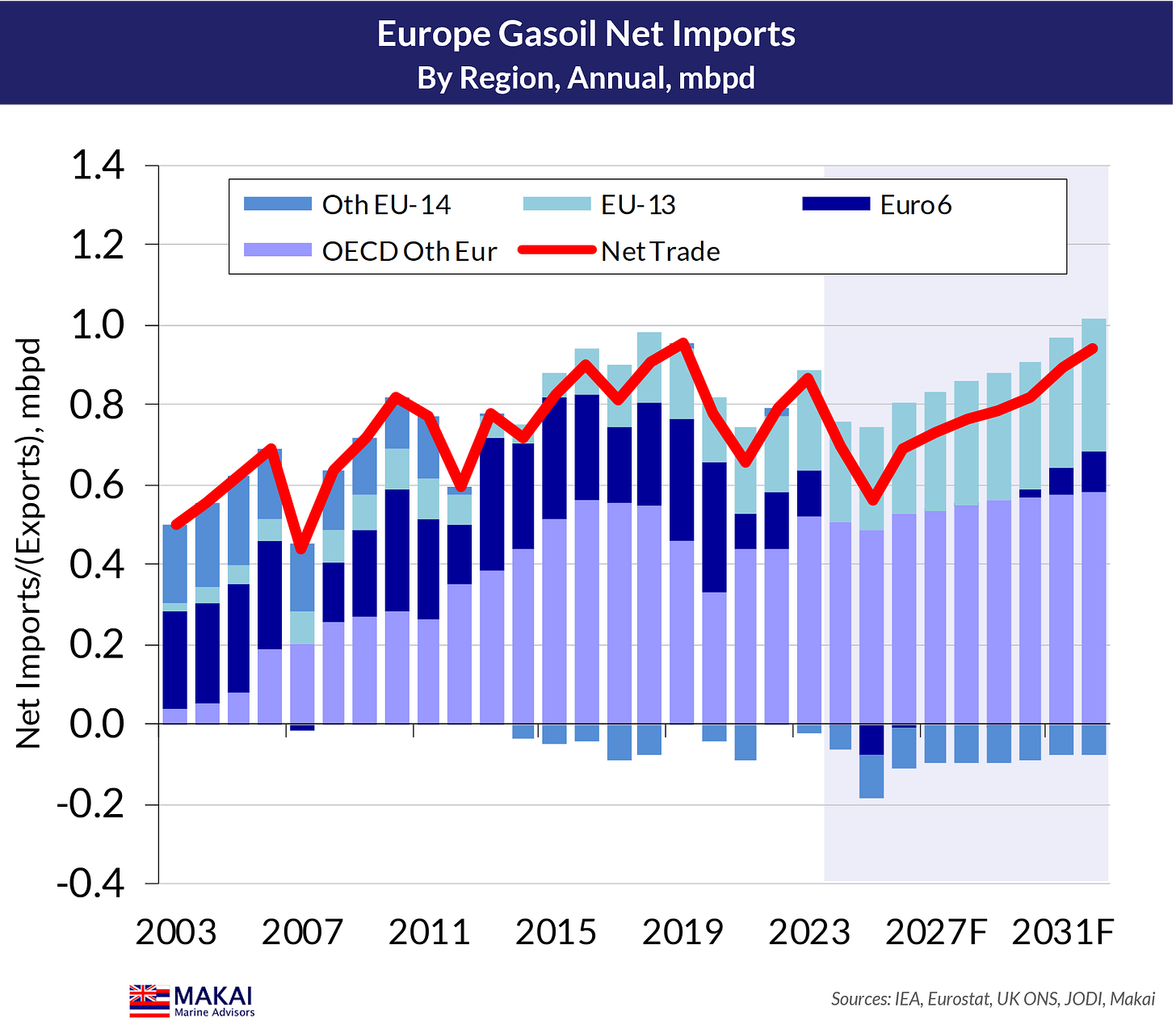

With intra-regional trade providing 60% of Europe’s gasoil imports, net imports are the more relevant measure, and the above chart shows the impact from de-dieselisation and the loss of refining capacity. Net imports take a similar 130 kbpd jump in 2026.

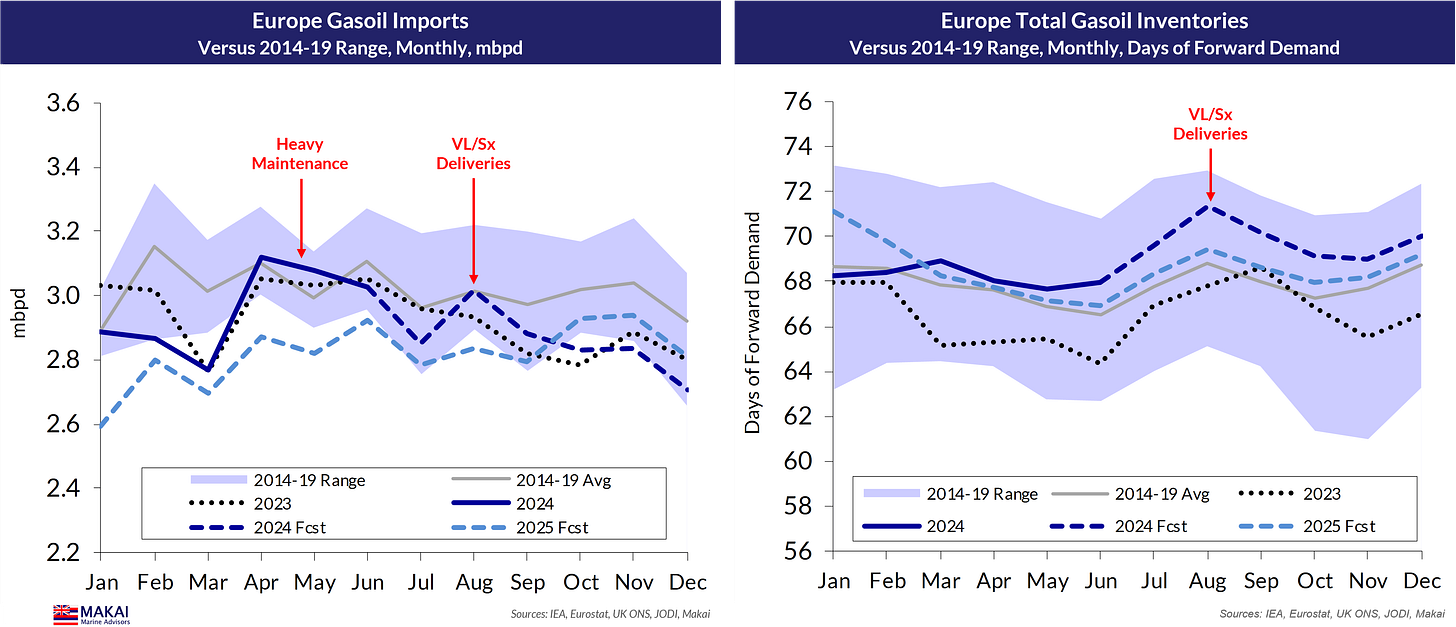

The emergence of cleaned-up dirty tonnage since June 2024 has pressured clean tanker earnings lower this summer, as Trafigura and other trading companies seek to protect their margins on Pacific Basin flows into Europe. As these vessels have lingered in the clean trade, and Trafi has hinted at adding to them, we suspect that they are trying to prevent a cape-routing-inspired spike in clean freight rates.

Inevitably, the impact of the initial VLCC and Suezmax deliveries are emerging in the inventory data. Euroilstock has reported that mid-distillate inventories of the Europe 16 countries have jumped by 7.94 million barrels (MB) during August. Insights Global data has revealed a similar movement, with ARA gasoil inventories now at 19.1 MB. As shown in the above charts, this level of inventory expansion should depress the level of required 4q24 imports into Europe, even if days of stocks remain above recent levels and averages.

Again, net imports are the more relevant measure for external sourcing, and 4q24 could see this metric hit its lowest level in 12 years. A spectacular seasonal freight rate spike is looking less likely.

Conclusion

For a regional refining system in which cracking refineries have a 67% share of capacity, this jump in gasoline demand and decline in gasoil consumption is welcome development for a group slated for execution. They might even become useful again, since our global refining and product balance models suggest a shortfall in refining capacity during 2027-29, from a pause in investment during the “refineries will be stranded assets” years. Wood Mackenzie and a few other oil consultancies share this view, with expectations of enhanced margins from this deficit – almost unthinkable at a moment of crashing refining cracks and sector gloom. So, we also share Wood Mac’s opinion that European refineries will survive, and that the 2025 closures will be the last through this cycle, until real BEV adoption can accelerate later in the cycle. In the meantime, the ordering of over 150 LR2s during the past 18 months might prove problematic for owners.

Top piece! I was thinking this the other way around, with the 150 kbpd Grangemouth refinery closing down, is taking Forties and WTI, where is that going to go? It will have to price into Asia.

On Dangote, if they really ramp up gasoline, simple refiners configuration, especially in the Meds are going bust... there aren't many outlets for "low grade gasoline" other than WAF. Middle East, East Africa maybe?

Great, thanks 🙏